Aug

2025

10 funds making 10% in July

DIY Investor

18 August 2025

Funds from five different sectors, including China and technology, made it into this top 10 for July – from Saltydog Investor

Technology & Technology Innovation was the leading sector in both May and June, and that dominance was reflected in our list of top-performing funds.

In May, five of the top 10 funds came from the Technology sector, with the remainder drawn from UK All Companies, Financials & Financial Innovation, North America, Global, and Specialist.

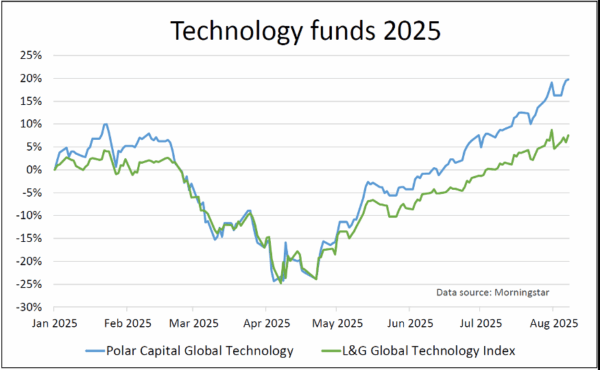

Leading the pack was the Polar Capital Global Technology fund, which returned 13.7% for the month, just ahead of Liontrust Global Technology and L&G Global Technology Index, which rose by 13.3% and 12.4% respectively.

In June, it was a similar story. Our top 10 included five funds from the Technology sector, two from Specialist, two from Global, and one from UK All Companies. The best-performing fund was Barings Korea, with a one-month gain of 19.4%, followed by Polar Capital Global Technology, up 12.3%, and Liontrust Global Technology, up 11.3%.

Five funds appeared in both lists: Polar Capital Global Technology, Liontrust Global Technology, L&G Global Technology Index, BGF World Technology, and Pictet – Robotics

July saw a more eclectic mix. Although China/Greater China was the best-performing sector, that’s not immediately obvious when looking at the leading funds.

Saltydog’s top 10 funds in July 2025

| Fund | Investment Association sector | Monthly return |

| Pictet-Biotech | Specialist | 13.4 |

| Matthews China Discovery | China/Greater China | 11.2 |

| BGF Sustainable Energy | Specialist | 10.9 |

| AXA Framlington Biotech Fund | Specialist | 10.7 |

| Polar Capital Global Technology | Technology & Technology Innovation | 10.7 |

| Polar Capital Smart Energy | Specialist | 10.7 |

| L&G Global Technology Index | Technology & Technology Innovation | 10.1 |

| Jupiter Financial Opportunities | Financials & Financial Innovation | 9.8 |

| Matthews China Fund | China/Greater China | 9.8 |

| Artemis US Select | North America | 9.7 |

Data source: Morningstar. Past performance is not a guide to future performance.

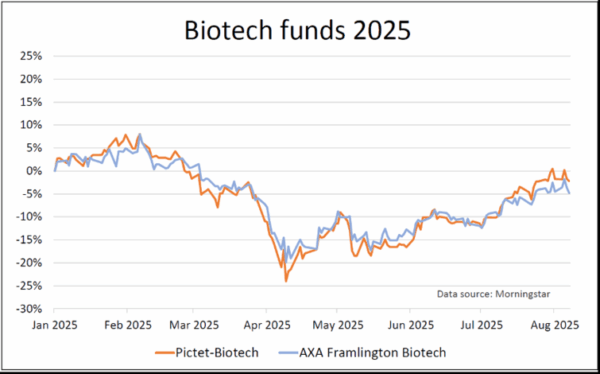

The Pictet-Biotech fund, which leads the table, invests in highly innovative companies working to address unmet medical needs, improve therapies, and reduce healthcare costs through advances in patient care and technology platforms. The AXA Framlington Biotech Fund, in fourth place, has a similar mandate and invests in many of the same companies.

The long-term case for biotech is straightforward. It addresses growing medical needs, particularly as populations age and chronic diseases become more common, driving continual demand for new treatments. The sector thrives on innovation, with an increasing number of breakthrough therapies reaching approval. More recently, higher levels of merger and acquisition activity from large pharmaceutical companies have also supported growth.

However, that does not mean these funds are without risk. They are among the most volatile we monitor, and it has been some time since they last topped the tables.

They made gains in January, struggled in February and March, and then fell at the start of April after Donald Trump’s “Liberation Day” tariff announcements. Since then, they have rebounded, but are still showing month-to-date losses.

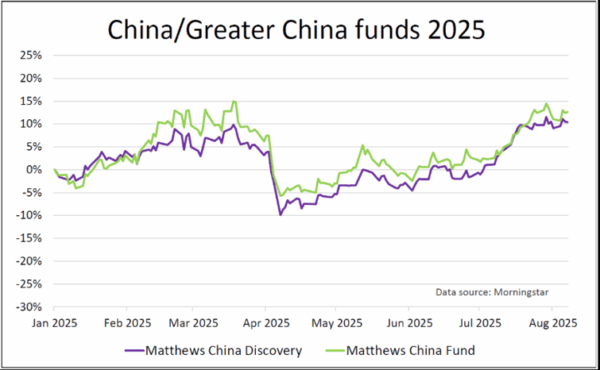

Last week, we wrote about the China/Greater China sector, which staged a big rally in July.

The two funds from this sector in our July top 10 also had a strong start to the year. They peaked towards the end of March, when the Matthews China Discovery fund was showing a year-to-date gain of 10%, while the Matthews China fund was up 15%. Both fell in early April, but have since recovered. Matthews China Discovery is once again up 10% for the year, while Matthews China has done better, although it remains slightly below its earlier highs.

Two funds have now appeared in our top 10 for three consecutive months: Polar Capital Global Technology and L&G Global Technology Index. Both rose in the first few weeks of the year, then fell sharply towards the end of January. They picked up in early February, but by the end of the month the gains had been wiped out.

By the end of March, both were showing month-to-date losses of 17%, and at one point they were down 24% from the start of the year. Since then, both have rallied, with the Polar Capital fund opening a significant year-to-date lead.

July’s top 10 reflects a slight shift from the recent tech dominance, with biotech making a rare appearance at the top and Chinese funds showing renewed strength.

Even so, technology remains resilient, with two funds maintaining a three-month run in our rankings.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.