Aug

2025

Active in AI: which trust to back in new world order

DIY Investor

16 August 2025

It is approaching three years since the launch of the first ChatGPT model, commencing a period of tech domination of global markets. As more and more AI models have since launched and the pace of innovation continues to grow, it has become clear that a new world order in AI is forming – by Richard Williams

At first the so-called Magnificent Seven stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) were synonymous with the AI growth story and propelled markets to new highs. That has since been whittled down to four, as Tesla dropped out and Apple and Alphabet lost momentum in the AI race.

It appears that there has never been a better time to back a manager with the requisite skillset and experience to make the most out of the rapidly evolving sector and to navigate the complexities and pitfalls.

Existential questions are starting to be posed – ones that are impossible for us mere mortals to know the answer to, but which have colossal implications for the sector and the world as we know it. Questions like whether app software will exist in the same way in 10 years’ time as it has done for the last 30 years, or whether/when we go to a post-smartphone world?

Given these intricacies, the advantage is starting to swing back in favour of active managers. Luckily there are a handful of investment trusts dedicated to spotting the AI winners and, arguably more importantly, avoiding the losers: the two largest – Polar Capital Technology (PCT) and Allianz Technology Trust (ATT) – as well as global trust Manchester and London Investment Trust (MNL), which is also exclusively invested in tech stocks.

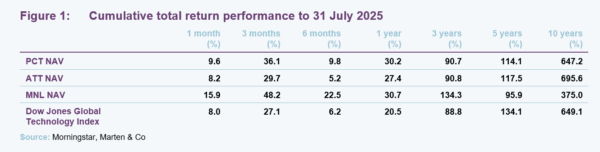

Figure 1 shows the recent strong outperformance of the three trusts compared to the Dow Jones Global Technology Index, which is weighted by the market cap of its tech constituents. This demonstrates that the active investment approach is working after a couple of years where it was near on impossible to beat the passive index, which is still dominated by the Mag7.

A dispersion, or broadening, of returns from the super-megacaps had been predicted for a while but appears to finally now be playing out. In recent results, ATT’s manager noted that super-megacaps (over $1trn) fell 4% in the six months to the end of June, while megacap (between $250bn to $1tn) and large-cap stocks (between $30bn to $250bn) were both up 6.4%.

Apple and Alphabet, which both suffered double-digit share price declines in the first half of the year, have long been among PCT’s largest underweight positions relative to the benchmark – and to a lesser degree at ATT.

Its underweight position in Apple was around 830 basis points (bps) at the end of June (3.4% versus 11.7% in the benchmark) and its exposure has since fallen to just 3.0% at the end of July, while ATT’s underweight position was 510bps at the end of June. Apple has struggled to deliver Apple Intelligence (its suite of AI features integrated into iOS 18 announced last year), which has put it on the backfoot and impacted the narrative around the company’s AI capabilities.

Alphabet’s underweight position in the PCT portfolio was the largest it has ever been at 420bps (2.9% versus 7.1%) at the end June, while ATT’s underweight position was 290bps. PCT’s manager fears that the company is facing an existential challenge to its search business, Google, and believes that AI-generated search is going to overtake Google at some stage – impacting its dominance in advertising spend.

PCT’s greater conviction, taking punchier underweight positions in these two tech titans, goes a long way in explaining its outperformance of ATT in all periods over the last year. Both trusts limit their exposure to any one stock, so the portfolio does not get too concentrated, meaning that both are structurally underweight the market leader Nvidia (although it remains the largest holding for both funds).

MNL has no such restriction and is heavily exposed to Nvidia (at 38.9% at the end of June) and Microsoft (at 26.0%). At almost 65% of the portfolio, the exposure to the two companies is conviction personified and has driven its sector beating performance over three years. However, the concentration risk is sky high. In its own words: “should either Nvidia or Microsoft have materially adverse events, then the fund will suffer material losses”.

PCT’s manager is fully in on AI and has adopted an ‘AI lens’ with which it assesses all stocks – even those that have traditionally been outside of the tech arena but are now being dragged into its sphere, such as companies involved in power generation needed for the ongoing spike in data centres. For example, GE Vernova (PCT’s 12th-largest portfolio holding at 1.4% exposure) has seen its share price rise 266% over 12 months.

PCT has held the edge on ATT over the past year, and as the capabilities and adoption of AI continues apace there is no reason why its greater conviction would not see that run continue. What is clear is that in a world that will increasingly be shaped by AI, backing an active manager with the resource and expertise to discover new entrants and avoid incumbent casualties has never been more apparent.

Published by our friends at:

![]()

Alternative investments Commentary » Brokers Commentary » Commentary » Investment trusts Commentary » Latest

Leave a Reply

You must be logged in to post a comment.