May

2025

Anchors away: Sailing the seas in search of a safe haven

DIY Investor

16 May 2025

Will new safe havens create new equity market opportunities…by Alan Ray

One of the consequences of the US administration’s approach to running the world’s largest economy, utilising the ‘move fast and break things’ strategy brought to prominence by Meta’s Mark Zuckerberg, is that it gives us live data on a host of incredibly complex systems. By providing a whole range of different stress tests to global trade, for example, we can learn in a matter of hours or days what might have taken a team of experts months or years to report on. Simply deciding to do something based mostly on intuition gives you an instant reaction as to whether that intuition is right or not. Part of the fascination with investing is learning about the interconnections that hold the global economy together and right now we have a grandstand view of how it all works.

Thus, we learned from a colleague recently that the imposition of charges on Chinese-made ships each time they dock at a US port could, ironically, be more positive for the US railroad network than for the US shipbuilding industry those charges are designed to support. The old practice of making a stop on the US’s West coast, then traversing the Panama Canal to make stops along the East coast to unload goods at the most relevant point may be replaced by a single West coast drop-off with road and rail networks left to do the remaining work. Whereas today’s trade policy may be tomorrow’s fish and chip wrapper, a burgeoning transcontinental railroad system certainly would be a return to the sepia-tinted great days of America.

The above isn’t intended as either an endorsement or criticism of the US’s unusual approach. Whatever one’s views, from an academic point of view, it is quite fascinating to watch the global trade system being revealed in a way it never has been before. As investors, we sometimes just need to take the view that ‘it is what it is’, set aside our personal views and not get too triumphant or downhearted. The above is instead merely a way to introduce the idea that, now the first 100 days of shock and awe have drawn to a close, putting our investor heads on, we need to start making pragmatic decisions about what opportunities might arise for us. One thing we should think about first is that a recession in the US will be bad news for stock markets generally. So that’s one thing to keep an eye on. One can be on either side, or no side, when it comes to the current US administration and, objectively, see that the odds of a recession have risen, regardless of whether this might ultimately be a ‘no pain, no gain’ moment or not.

Of course, the common narrative is that everything is still in flux and is a negotiating tactic, and our fish and chip wrapper reference, opaque to any non-UK readers, or anyone born after 1980, shows even we can’t help thinking the same. But one shift already seems quite certain. The US’s position as the leading ‘safe haven’ for financial assets has diminished and global capital flows have already changed direction, with, for example, the Euro and the Yen both significantly strengthening as capital moves to these alternative safe havens. And one doesn’t need to be a US policy naysayer to see this as a long-term shift. If one’s intention is to re-energise domestic manufacturing, then having a permanently strong currency doesn’t make it easy. Shedding this burden may indeed be part of the plan.

It therefore seems very likely that global investors will seek a more diversified approach to their reserve, or safe-haven, assets. There is no one asset that presents an exact alternative but there are a few relatively obvious ones which already hold safe-haven status and may see further capital flows. How, as investment trust investors, might we benefit from this shift?

Europe. Or more specifically, Germany

Whereas the new German government did, at the time of writing, experience a small hiccup in getting the chancellor confirmed in the Bundestag, the agenda is now set for greater spending on infrastructure and defence, and this will inevitably involve greater borrowing. The German government finds itself in a position where it is about to ramp up production of a ‘product’, German bonds, just at a time when the export market for the same product is looking more promising. The Euro is already, year-to-date, 9% stronger against the dollar and German ten-year bond yields are largely static despite the market anticipating an increase in borrowing. This seems incredibly neat, and although the relatively weak government coalition may provide some glitches, overall this seems like a strong position to be in.

One potential beneficiary of this is pan-European property specialist TR Property (TRY). First because, generically, lower government bond yields ultimately tend to be positive for real estate valuations. Second, real estate is often an asset class that long-term investors seek as an addition to holdings in bonds. Third, because an infrastructure programme could be accompanied by strong demand for the commercial real estate that goes to support that programme, be that office or industrial assets. And, ultimately, the largest sector in TRY’s portfolio is the listed German residential sector. Lower borrowing costs and positive economic growth will both be tailwinds for this sector.

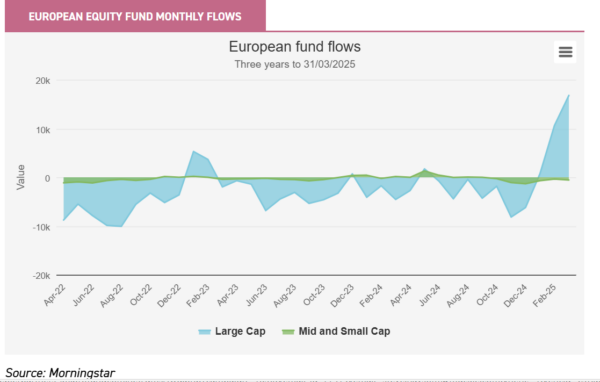

One can also see a pathway for some German equities to do well from this. Germany’s industrial sector has been under significant pressure in recent years, with higher energy costs and slowing global economies, but there are green shoots. It is true to say that investors have firmly latched on to defence stocks, which have seen extraordinary share price moves in the opening months of 2025. Many institutional investors, bound by ESG policies, have missed out on this rally, which appears to be led by retail investors. One investment trust relatively early to the potential is European Smaller Companies (ESCT), which took stakes in a number of European defence stocks in 2023 and 2024 and, while this remains a key theme, share price performances mean it has already taken profits in some key stocks. ESCT’s largest single country allocation is to Germany, at 23%, nearly twice the weight of the index and this exposure is driven by the manager’s desire to get exposure to Mittlestadt companies likely to be direct beneficiaries of rearmament and the infrastructure spending programme. European equities have seen a shift in investor sentiment this year, with the main indices up c. 12% compared to a c. 8% decline in the S&P 500 (in Sterling terms). The chart below plots the positive fund flows that European equity funds saw in February and March, about $27bn worth, which represents the first major uptick in sentiment toward European equities for several years. The little green area on the chart is the separate flow in and out of specialist smaller companies funds, which is where ESCT lives, and shows that, despite European smaller companies keeping pace with larger-cap equities this year, international investors haven’t yet alighted upon them. This is a normal part of a change in sentiment, where one might expect the first wave to be more focussed on the index. In time though, this could be a very powerful tailwind for smaller companies.

Japan

A bit like Germany, Japan is no stranger to investors who seek safe-haven assets, with the Japanese currency and government bonds seen as reliable investments, and, like the Euro, the Japanese Yen has appreciated significantly against the US dollar this year exactly for that reason. Japan and Germany are also export economies so an appreciating currency is, simplistically, not ideal. The US administration, of course, would like the benefits of a weaker currency to fuel its industrial growth, even if policy statements specifically relating to the dollar’s strength are, not for the first time in US history, rather vague.

Further, capital flows into a currency don’t necessarily translate to flows into equities. But Japan is a bit like Germany, undergoing its own period of transformation that means that its equities are increasingly seen by overseas investors not just as the cyclical opportunity that has dogged Japan’s stock market for so long, but as a place where companies are finally getting to grips with shareholder value. In a year when any company, in any part of the world, could be forgiven for holding onto cash, Japanese companies have continued to buy back shares at a record pace, breaking a generational habit of hoarding cash at the expense of shareholder returns. Schroder Japan (SJG) has built a strong track record over the last five years identifying and capitalising on this change. Over half the portfolio is positioned in small- and mid-cap companies and this provides the clue that SJG is primarily exposed to companies with a domestic bias, rather than the exporters that Japan is known for. AVI Japan Opportunity (AJOT) is the specialist in the field of corporate change that has led to many companies improving shareholder returns, taking a more direct hands-on approach to its investments. The opportunity for Japanese equities to attract some of the positive capital flows into the Japanese safe haven looks as positive as it has done for decades.

Gold

The traditional safe haven of gold has, of course, reared its head recently with record price highs. There are a couple of things going on here. First, the short-term markets, notably the US, have been volatile and this has led investors to reach for gold as they would do traditionally. But it seems quite likely a longer-term trend is also gathering pace, again because investors are seeking alternatives to US treasuries on a permanent basis. China owns vast quantities of US treasuries, second only to Japan, but has a surprisingly small gold reserve in comparison to its overall reserves. China appears to be quietly accumulating gold and this may be one of the key drivers behind price highs. Chasing price highs is always a fraught decision, but as investors we can choose more than just the physical gold exposure and instead take the broader mining exposure offered by BlackRock World Mining (BRWM), with over 20% exposure to gold miners. Sitting in the same peer group, Golden Prospect Precious Metals (GPM) offers investors a more explicit way to focus on gold and other precious metals, in contrast to BRWM’s more diversified approach that includes industrial commodities. Many of the stocks GPM owns have performed very well over the last year, but the managers feel this is more related to investors unwinding their underweight positions than to the full effect of the higher gold price feeding through to corporate earnings and so they note that shares in gold miners remain cheap and are likely to perform well if gold continues its current path.

Conclusion

As investors, it may be helpful to take a ‘neutral Swiss’ approach to assessing what the next few hundred days and beyond might bring, and in mentioning Switzerland we remind ourselves that there are other traditional safe havens that are seeing positive capital flows. Wherever one sits on the spectrum of opinions on the US, keep in mind that, in our view, it’s fanciful to imagine that the US is still anything other than the single most important destination for equity investment – and US treasuries are still the leading safe-haven asset. Whatever one thinks of the factors that make the US ‘exceptional’, some of the most important, scale, geography, culture, natural resources, and education aren’t just going to evaporate. Increasing manufacturing exports while maintaining a very strong currency is a difficult square to circle though, and it is not inconceivable that, by accident or design, this reduction in the US’s safe-haven status is exactly the catalyst the US is looking for. For investors, it may create multiple opportunities elsewhere.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.