Jun

2025

Any port in a tariff storm – Performance of investment styles during past recessions

DIY Investor

1 June 2025

Trump’s presidency is now 100 days old and, while it is still early days, this milestone is seen as a point of reflection on a new president’s tone and approach, which is perhaps more useful than not, given Trump and team’s willingness to move fast and break things – by David Johnson

The mood certainly feels ominous: while some may have believed that Trump’s term would be remembered as a golden era for corporate America (myself included, considering I selected Pershing Square as one of my fund picks for the year), the reality so far has been starkly different.

Trump’s rapid implementation of a sweeping tariff regime, dubbed ‘Liberation Day’, has resulted in the highest average US tariffs in nearly a century and has sent shockwaves through the global economy.

Trump has, however, given the world a 90-day grace period to try and strike new trade deals with the US before the tariffs take effect – with the exception of China, on whom he has raised tariffs to an astonishing 145%. Given that the Trump administration has only 68 days left of his self-imposed deadline to negotiate deals with 57 countries, this seems an impossible task, and something will have to give. While Trump has yet to climb back from his strong-man stance of his tariffs, there have been signs that he has needed to face reality, having already signalled the possibility of scaling back tariffs on China for example, exempting certain electronics items such as smart phones and computers.

Ultimately though, he is unlikely to want to abandon one of his core policies without a fight and given that his last presidency was characterised by unpredictability, it is quite possible that, come 9 June, global trade will once again be upended.

Keep calm and carry on buying small-cap quality

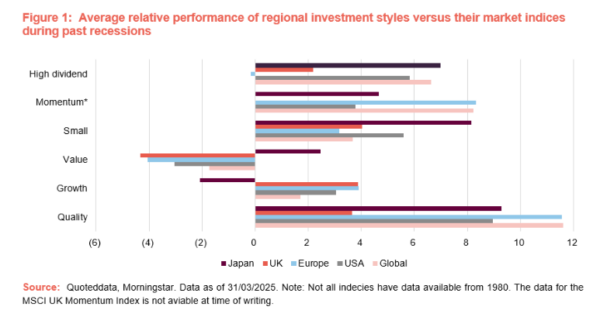

If a tariff-induced slowdown does prove inevitable, where might investors seek refuge? Looking back at history, we can see that certain equity investment styles have outperformed the broader market during periods of economic slowdown, as shown in Figure 1.

The data shown in Figure 1 uses the OECD’s classification of a recession, showing the average performance of the respective MSCI style index relative to its wider market index during their region’s recessions since 1980, in local currency terms where possible.

There are distinct trends across all five regions, where high-quality or smaller companies have historically outperformed other investment styles. We also highlight the growth factor as another notable outperformer – underperforming only in Japan – and often closely linked with quality, as both styles tend to command higher valuations than the wider market and as a result often leading them to be packed together in a single investment strategy.

While high-quality dividend payers certainly exist, high dividend yields are typically associated with the value investing style, which complicates the investment case for many high-dividend strategies, given the underperformance of the value factor.

Momentum has also been a significant outperformer during this period. However, it can be a self-fulfilling prophecy, as purchasing other known outperforming styles may naturally lead to incidental exposure to the momentum factor.

Why, then, might the quality and growth factors outperform during a contraction? One answer lies in easing monetary policy. Economic contractions are often deflationary, and when combined with weaker activity, typically prompt central banks to adopt a more accommodative stance. This becomes a significant catalyst for growth and quality companies, whose higher valuations and longer growth runways make them more sensitive to interest rates.

Another explanation may be changing investor behaviour during recessions. In uncertain economic conditions, the quality and growth factors can become perceived safe havens – offering either greater certainty of growth where it is scarce, or confidence that strong companies with high-quality management teams and superior balance sheets are best placed to navigate tough periods.

The small-cap factor is somewhat more puzzling. Conventional wisdom suggests small caps should underperform during recessions due to their higher sensitivity to domestic economies. One explanation could be that larger companies are more closely scrutinised, and markets may de-rate them more quickly in a downturn. Small companies may also be more sensitive to interest rates than large caps. While UK and European small caps do show greater exposure to the growth factor than their broader indices, this sensitivity may instead reflect their greater leverage; as well as thrm have higher exposure to floating-rate debt, meaning that lower rates feed directly through to their bottom line.

Who would be the winners?

Of the five sectors we have chosen, we explore the opportunities within the UK, Europe, and Japan. Given that Trump’s policies may well be the catalyst for a near-term contraction – having already caused a 0.3% decline in US quarterly GDP – we believe investors may be looking beyond the US (and by extension global equity strategies given their large US exposure). Lower valuations in our chosen regions may make them more attractive, either because they have less room to fall, or because investors are avoiding US markets until the political dust settles.

There are several trusts that align well with the style characteristics sought during a recession, typically offering a combination of quality, small-cap, and growth factors.

UK

Within the UK, three trusts stand out for combining all three factors: BlackRock Throgmorton (THRG), Montanaro UK Smaller Companies (MTU), and abrdn UK Smaller Companies Growth Trust (AUSC). All three describe themselves as ‘quality growth’ mandates, and while their style exposures to small-cap and growth are broadly similar, MTU has the strongest bias (according to Morningstar).

THRG edges ahead on performance, boasting a superior track record over both five- and ten-year periods, and currently trades on a wider discount than the other two.

However, two of these trusts have a unique differentiators: THRG’s is its ability to use short positions, and MTU’s is its new dividend policy – 6% of NAV per annum (1.5% per quarter) giving it a high yield in a sector traditionally focused more towards capital growth. Though THRG’s short exposure is only a small portion of its portfolio, short positions have the potential to offer THRG upside from falling share prices. MTU, on the other hand, offers shareholders a c.6% yield (funded by its NAV) following a recent increase in its target payout. This sets it apart from nearly all other UK small-cap funds (open or closed ended), as highlighted in our recent note on MTU, and enables income-focused investors to access factors their investment requirements might typically exclude.

Europe

In Europe, investors are almost spoilt for choice, with many trusts offering exposure to quality, growth, or small-cap factors. However, the most comprehensive combination appears in the Montanaro European Smaller Companies Trust (MTE). According to Morningstar, MTE offers the best blend of quality, growth, and small-cap characteristics among European trusts. Unsurprising as its manager, George Cook, is a committed quality-growth investor.

MTE has the second ‘smallest’ portfolio and the highest growth bias, along with standout quality metrics such as high ROIC and low leverage. The board has also made proactive changes to improve shareholder value, including measures to tighten the discount and reduce fees.

Honourable mentions include BlackRock Greater Europe (BRGE) and European Opportunities Trust (EOT). While both also show strong quality and growth characteristics, they skew towards large caps, though EOT leans more heavily into mid-caps. Its manager looks for ‘special’ companies, which it describes as niche winners in their respective fields that can flourish in a range of economic scenarios.

Japan

Japan stands out as the only region where growth underperformed during recessions. However, this doesn’t mean investors cannot still capture Japan’s outperforming styles – particularly given that Japan has historically shown the strongest small-cap outperformance.

A strong candidate is the AVI Japan Opportunity Trust (AJOT). Its activist strategy naturally lends itself to investing in smaller companies. While the cheapest end of the market may offer greater upside potential from activism, the AJOT team are conscious of the potential ‘value-trap’ these low-quality businesses can be. Instead, they prefer to focus on the companies which demonstrate sufficient quality while still potentially benefiting from activism, as to not be caught out by the perils of low quality businesses during market downturns. As such, AJOT’s valuation ratios remain comparable to the broader small-cap space, while also delivering better quality metrics, such as higher ROE.

AJOT also offers advantages that extend beyond its potential style tailwinds, as its activism offers distinct return opportunities, even during downturns, as successful reforms can drive share price re-ratings independent of broader market conditions.

Published by our friends at:

Brokers Commentary » Commentary » Equities Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.