May

2025

Blood, toil, sweat and tears

DIY Investor

4 May 2025

We examine the performance of our ‘bulletproof income portfolio’ after ten years of volatile markets…by Pacal Dowling

The Toraja people of Indonesia, a tribal group indigenous to the mountains of South Sulawesi, are known to mark major anniversaries of their departed loved ones via a ritual known as the Ma’nene which roughly translates at the ‘Festival of Cleaning Corpses’.

Family members will exhume the bodies of deceased loved ones, clean them, re-dress them and sometimes dance and share meals or cigarettes with them – although it is to be assumed that the deceased aren’t big eaters and never ‘lead’ in the foxtrot.

Kepler Trust Intelligence is approaching its tenth anniversary this month and, in very much the same spirit, we thought it would be interesting to dig up our very first attempt to predict the future and see how it looks after ten rather tumultuous years for investors.

Kepler Trust Intelligence began life as a quarterly newsletter, sent to discretionary wealth managers, and our first edition a ‘fantasy portfolio’ which, in our view, could deliver attractive returns for income investors.

Presumably because we had been smoking something at the time, we decided to call it the ‘Bulletproof Income Portfolio’ which, I suspect, would not get past our compliance team these days.

This somewhat brash title reflected what we wanted to achieve, though, which was a diversified approach to income which would together generate a solid income over many years.

Our aim, stated at the time, was thus:

“Our aim has been to build a portfolio, which on an underlying basis is relatively diversified globally, but (in view of the fact that our readership is entirely UK based), not so much that foreign currency movements against sterling will have a significant impact.

“In our mind, the best way to look after income is to make sure that the capital is being looked after, and the income should follow. As such, we have a preference for trusts which are not, in our view over-stretching themselves to sustain the current level of dividend.

“Our aim is to provide an income in excess of the FTSE All Share (currently 3.3%), but which is highly unlikely in our view to suffer a dividend cut in any year, and should over time, deliver a rising dividend at very least keeping pace with inflation.”

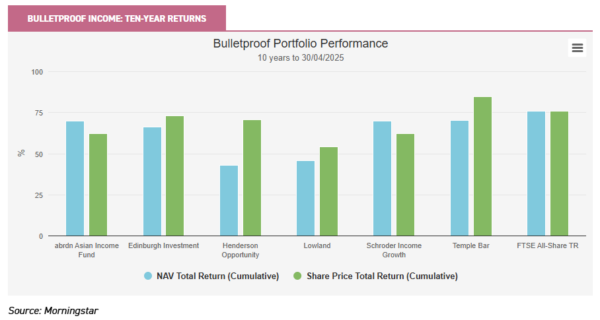

The table below shows how these trusts have performed. Two of the trusts in our portfolio cut their dividends in the last ten years, and NAV total returns were slightly behind the FTSE All-Share, which is a little disappointing.

| trusts | nav total return (cumulative) | SharePrice Total Return (Cumulative) |

12 Mo Yield | Latest Discount (Cum Fair) |

| abrdn Asian Income Fund | 69.65 | 62.11 | 6.9 | -10.1 |

| Edinburgh Investment | 66.08 | 72.78 | 3.5 | -8.1 |

| Henderson Opportunity | 42.8 | 70.6 | 3.3 | -10.0 |

| Lowland | 45.40 | 54.21 | 4.8 | -6.7 |

| Schroder Income Growth | 69.65 | 62.11 | 4.9 | -9.2 |

| Temple Bar | 70.04 | 84.45 | 3.8 | 3.8 |

| FTSE All-Share TR | 75.87 | 75.87 |

Source: Morningstar

Past performance is not a reliable indicator of future results

Given that the backdrop here was a succession of ‘once in a lifetime volatility events’ including COVID, the possible outbreak of World War Three, the collapse of the Tory party, and Donald Trump’s first and second terms, the real picture here is one of resilience.

abrdn Asian Income (AAIF), Schroder Income Growth (SCF) and Lowland (LWI) did not cut their dividends and deserve credit for that particularly given aforementioned flock of ‘black swans’ that hit the market during this period. They retain their crowns as ‘AIC Dividend Heroes’.

Edinburgh Investment Trust (EDIN) cut its dividend in 2021, having maintained it for fourteen years prior to that point, but this reflects in our view prudence on the part of a decisive board; the yield at the time was +7% and the mandate was subsequently taken away from Invesco’s Mark Barnett and handed to Liontrust. The trust is now up 112% over five years vs 45% from the All-Share.

Further, with the exception of Lowland the portfolio’s underperformance vs the All-Share over the whole ten year period (the constituents of which are not tied to any obligations on dividends) is marginal.

The renaissance of Temple Bar (TMPL) is also worth highlighting.

After a period in the wilderness for Temple Bar during the early years of our portfolio when value was in the depths of its doldrums, it has bounced back sharply and is on a three year view a rock-star – delivering more 143%, or twice the average for the AIC UK Equity Income sector.

When we put this portfolio together ten years ago, William Heathcoat Amory and I were the only people working on Kepler Trust Intelligence, and our audience was around 3,000 wealth managers (among whom perhaps 50% read our first edition).

Today we have six analysts and two former journalists producing insight and research about investment trusts, and a team of eight behind the scenes making sure that all of this information reaches our audience of more than 300,000 people in a typical year.

It would’ve been nice to report a barnstorming success for Bulletproof Income over the years it has taken to get to this point,but in a way this more nuanced result is probably more interesting – as an honest example of what happens when a plan makes contact with the battlefield.

You cannot know what lies in store for your cherished selections, no matter how carefully you choose them or how solid their credentials. Investing, like anything that’s worth doing, is hard.

In my next blog we will examine the fortunes of another of our model portfolios – the Endurance Growth Portfolio. In the meantime I’m off to smoke a cigarette with my dearly departed father.

Courage mon brave!

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.