May

2025

Fear vs optimism? UK retail investors emerge as the world’s most hopeful

DIY Investor

30 May 2025

- Fear of loss (37%) and optimism (36%) are the top emotional drivers steering UK retail investor decisions

- Investment losses spark caution but also resilience among retail investors

- 54% of UK retail investors admit personal experiences and emotions influence their investment choices

British retail investors are the most optimistic in the world when it comes to making investment decisions, according to data from the latest Retail Investor Beat from trading and investment platform eToro

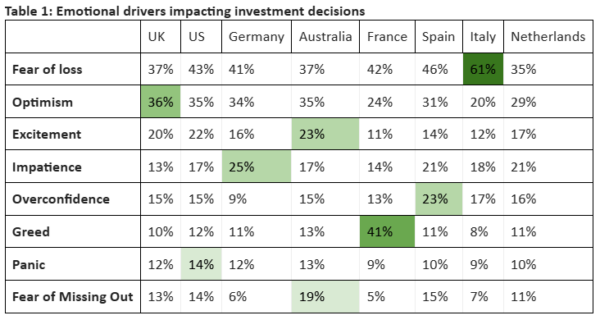

In the study of 10,000 retail investors across 12 countries, the data shows that fear of loss and optimism are the top two emotional triggers affecting retail investors’ investment decisions. 37% of British investors identified fear of losing money as the emotional driver that most significantly impacts their investment decisions, while 36% cited optimism as the main factor (more than any other country). Excitement was chosen by 20% of UK retail investors, followed by overconfidence (15%), impatience (13%), fear of missing out (13%), panic (12%) and greed (10%) – suggesting a complex but ultimately resilient psychological profile among British investors.

Commenting on the data, eToro’s UK Managing Director Dan Moczulski said: “This data paints a picture of UK investors as optimistic, disciplined, and resilient. It also challenges the outdated trope of retail investors as ‘reckless’ speculators driven solely by fear of missing out (FOMO). Instead, the majority are taking a thoughtful, long-term view, choosing to stay the course even during periods of volatility. This cautious behaviour is likely amplified by ongoing uncertainty, making the need to carefully weigh risks and opportunities more essential than ever.”

A decline in the value of their investments brings caution and resilience

The study also found that UK retail investors become more reflective when they experience losses on their investments. Half (50%) say seeing the value of their investments decline made them more cautious, one in five (20%) believe it made them more resilient as an investor, and 16% think it had little or no impact on them. A further 19% say losing money on their investments made them less confident.

Whilst UK retail investors become more cautious when the value of their investments decline, the data shows that they adhere to long-term strategies to navigate market volatility. The study reveals that more than half of the respondents (56%) stay the course and maintain their existing investment strategy during volatile times, compared to 48% globally, while 16% opt to rebalance their portfolios, 13% see market volatility as an opportunity to buy more investments, and only a small fraction (9%) react by selling off their investments.

UK investors less swayed by emotion

Globally, 86% of retail investors admit that personal experiences and emotions influence their investment decisions, with just 11% saying these factors have no impact. However, British investors appear to take a more considered, analytical approach with only 54% believing emotions play a role in their decisions, while a notable 44% say they are not influenced by them at all – the highest scepticism among all countries.

These findings suggest UK retail investors may view themselves as more strategic and rational in their decision making, favouring logic over emotional reactions when navigating the markets.

Commenting on the data, eToro’s Global Market Strategist Lale Akoner added: “Experiencing losses often triggers a natural psychological response, prompting investors to protect their remaining capital. However, these setbacks also build resilience, leading to greater confidence and perseverance in navigating market fluctuations. Historical data shows that the S&P 500 has recovered from over 25 declines of 10% or more since 1928, achieving an average annual return of around 10%. Retail investors’ commitment to long-term strategies suggests they recognise that short-term losses are a part of the journey toward achieving long-term financial goals.”

Dr Heloïse Greeff, Elite Pro Popular Investor on eToro, added: “Over my nine years on eToro I’ve watched the conversation among retail investors mature dramatically. A decade ago market dips sparked almost pure fear; now the dialogue is far more balanced, focused on long-term opportunity and disciplined risk management. Fear still keeps us diligent about risk, but it’s optimism—and a clear long-term plan—that keeps people invested through the cycles. The investors who stay curious, acknowledge their emotions, and stick to their strategy are the ones who ultimately build real resilience and lasting wealth.”

About this report

The latest Retail Investor Beat was based on a survey of 10,000 retail investors across 12 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 600 respondents: Netherlands, Denmark, Poland, Romania, and the Czech Republic.

The survey was conducted from 18 February – 4 March 2025 and carried out by research company Opinium. Retail investors were defined as self-directed or advised and had to hold at least one investment product including shares, bonds, funds, investment ISAs or equivalent. They did not need to be eToro users.

Leave a Reply

You must be logged in to post a comment.