Mar

2025

Get rich slowly: Stars in EUR eyes

DIY Investor

31 March 2025

Our investment expert considers adding more Europe, but gets distracted…by David Brenchley

Ten years ago, Australia entered the Eurovision Song Contest, much to the bafflement of many, who pointed out that the country was not, in fact, in Europe. In a similar vein, there’s been recent speculation over whether Canada should join the European Union (EU).

Indeed, a recent survey from Abacus Data showed that 44% of Canadians think their country should join the EU versus 34% that think it shouldn’t. On the face of it, surely if Australia can join – and finish runner-up in – Eurovision, Canada can join the EU, given it is part of the Commonwealth and has an English and French-speaking population?

Interestingly, Eurovision has a history with non-European countries taking part: Israel has won four times and Morocco participated in 1980. The EU, not so much: the European Parliament states that “in order to apply for EU membership, a country has to be European”.

Still, the speculation over Canada joining the EU is interesting. The same survey showed that while 55% of Canadians see the US as its most important partner currently, just 38% think the US will be Canada’s most important partner in the next three to five years. The EU by contrast rises from 43% currently to 52% in the future.

This is perhaps not too surprising, given US president Donald Trump is due to slap punitive tariffs on Canadian goods on Wednesday, as well as his overtures to Canada to become the 51st US state.

Shifting sands

Are we seeing a similar shift in the investment world away from the US and towards Europe? The latest fund manager survey from Bank of America suggests so, reporting that global fund managers reduced their weighting to US equities by a record 40 percentage points between February and March, with a near-30 percentage point jump in allocation to European stocks.

That’s coincided with a period of better performance from European bourses than their transatlantic counterparts. The scores on the doors as we reach the end of Q1 2025 sees the Stoxx 600 registering a c. 7.4% gain, the FTSE 100 up c. 5.2% and the S&P 500 falling 2.6%.

Losses suffered by Europe- and UK-based investors holding US index funds have been steeper, since the US dollar has also fallen. The Vanguard S&P 500 UCITS ETF, the most popular way for UK investors to track the US index, has fallen c. 6.5% this year.

So, should more investors mirror Canada, and global money managers, and send some of the extraordinary profits they’ve made from the artificial intelligence bubble to Europe? Valuations certainly suggest that they should.

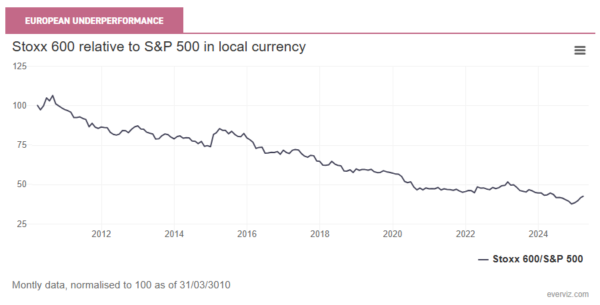

The following chart shows the performance of European stocks’ relative to US equities. You can see that even after the very recent bounce off lows, there’s a long way to go before erasing America’s post-financial crisis exceptionalism.

It’s certainly got me reviewing my exposure to Europe as a region. As a colleague pointed out this week, Europe is home to many global, market-leading companies. They don’t just sell their products and services in Europe itself; they just happen to be listed on stock markets there.

In December, I started building a new position in Montanaro European Smaller Companies (MTE), which has been well-timed. I’m well aware that I have a significant home bias of c. 22%. That’s because UK small- and mid-caps look cheap and attractive and I’m happy with my exposure there. There is scope to increase the rest of Europe, too, due to the Continent’s cheap valuations.

I could add more smaller companies, through European Smaller Companies Trust (ESCT), which would complement the growth-focused MTE with a slightly more pragmatic, style-agnostic approach.

I’m a believer in the small-cap effect, but I wonder whether a large-cap trust might add some extra diversification. Here, the choices I give myself are Fidelity European (FEV) and WS Lightman European, the former being a growthier portfolio and the latter value.

On the hunt for value

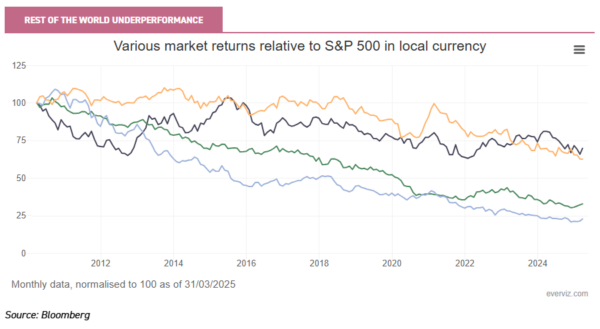

However, as the below chart shows, pretty much every other region looks cheap relative to the US, too – including US small caps, represented by the Russell 2000 in the yellow line. Europe sits somewhere in-between the yellow and green lines.

Indeed, my best-performing holding so far this year has been Fidelity China Special Situations (FCSS), which is up c. 25%, while Temple Bar (TMPL) has also done well up c. 11%, suggesting cash is flowing to other cheap markets as well as Europe.

Looking through my underlying regional exposure, there are some key underweights that perhaps I should consider rectifying before adding to Europe.

I’ll admit that I thought US small caps might have performed worse than they have relative to the S&P 500: mega-cap outperformance has only been a recent phenomenon, taking off around the start of 2021. Still, I have exposure here through the VT De Lisle America fund, as well as via global smaller company funds such as Global Smaller Companies (GCST) and Smithson (SSON), and am not inclined to add more for now.

In local currency terms, Japan hasn’t underperformed the US by as much as other countries or regions, but there’s a sense that the yen is hugely undervalued meaning that if is recovers then overseas investors could benefit.

Take the period from 27/12/2024 and 07/02/2025 as a prime example. The FTSE Japan index fell c. 2.6% in yen terms during this period, but the yen itself jumped by c. 5% versus pound sterling, meaning the Vanguard FTSE Japan UCITS ETF returned c. 1.4%.

In addition, the catalyst for unlocking value in Japan seems to be in place, in the continued corporate governance reforms. It seems remiss, then, that I have no Japan-specific investments, meaning that Japan accounts for c. 3.8% of my underlying regional exposure.

My approach to Japan is likely to be two-pronged: finding an activist specifically trying to unlock corporate governance improvements and searching for an income mandate to take advantage of rising dividends from Japanese companies. Nippon Active Value Fund will most likely take account of the former, while either CCJI Japan Income & Growth (CCJI) and/or WS Zennor Japan Equity Income will take care of the latter.

Global emerging markets trusts including Fidelity Emerging Markets (FEML) and Pacific Horizon (PHI) are part of my core allocations, but I have been tinkering around the edges.

As mentioned already, I have a small additional allocation to China vis FCSS and a recent sell-off in India’s stock market allowed me to start a small position in the sector-leading Ashoka India Equity (AIE) on a small discount. You can listen to a recent podcast I did with AIE’s Ayush Abhijeet here, where he opines on the reasons for the sell-off and where his team is seeing opportunities.

Whether we’ll see any more non-European countries taking part in Eurovision, or if any will be allowed into the EU, remains to be seen. Now does seem as good a time as any to revisit the reasons for being underweight European equities. Don’t forget, though, there are plenty of other undervalued regions out there, offering the opportunity to diversify returns away from expensive US stocks.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Alternative investments Commentary » Brokers Commentary » Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.