Apr

2025

I’m So Bored With the USA: Systemic Threat

DIY Investor

25 April 2025

“I was early to finish, I was late to start

“I was early to finish, I was late to start

I might be an adult, but I’m a minor at heart”

Systemic threat can be defined as “a threat to an entire system rather than just to some part of the system”. Typically, it is used in finance, for example the GFC posed a systemic threat to the global financial system.

This article considers the threat tariffs represent to the global financial system, and also the systemic threat of the climate crisis. But, it goes further, considering the systemic threat of two politicians, Donald Trump and Nigel Farage.

Farage other than promising tax cuts is relatively unforthcoming over his economic policies, although he is good at jumping on bandwagons, E.G., renationalising British Steel.

‘Trump the full espresso to Farage’s decaf version’

News that Chancellor Reeves could be forced to raise taxes or announce deeper cuts to public spending after figures revealed UK borrowing overshot official forecasts by almost £15bn in the last financial year, seem to pass him, and many of his supporters, by.

It should be of great importance, it is the basis of what money a government has to spend. This overrun, allied to the mounting strain caused by Donald Trump’s escalating trade war, comes less than a month after cuts to sickness and disability benefits and reductions in public spending to rebuild £9.9bn of headroom against the main fiscal target.

As a result, a fiscal rethink across the upcoming spending review and autumn budget looks increasingly likely, as, even before recent tariff announcements the spring statement felt like a stopgap that left more questions than answers. In the autumn, statement it appears the government will have to choose between raising taxes, bending its fiscal rules, making further spending cuts, or combination thereof.

‘a fiscal rethink across the upcoming spending review and autumn budget looks increasingly likely’

But then, Farage doesn’t need policies, he needs grievances, victims, something or someone to blame. His supporters in-turn are looking for something to blame for whatever they perceive to be wrong in their lives. Many, the victims of inequality, have genuine grievances but nothing Nigel promises will change that, more likely he will make it worse.

Brexit and his old anti-European bandwagon has served him well, providing more than his 15-mins of fame. Having cast his eye over immigration, which, perhaps gives him concerns that he might be seen as racist, he has turned his attention to climate-scepticism, rallying demoralised, alienated voters against arrogant metropolitan elites: “This could be the next Brexit, where parliament is so hopelessly out of touch with the country.”

In this, he is supported by a predominantly right-wing media, who take every opportunity to present the energy secretary, Ed Miliband, as a zealous crank. And, with the Labour’s current unpopularity causing incumbent MPs to look in the rearview mirror as Reform eats into their majorities, many see Miliband as an electoral liability.

Inside Downing Street. no one seems to be contemplating a climate U-turn in the face of Farage’s criticisms. Instead, it is expected that PM Starmer will reaffirm his commitment to the renewable energy transition in a speech at an international summit in London, co-chaired by Miliband.

Starmer’s case is based on economic pragmatism and the national interest; investment in high-skilled, high-wage industries, and ending our reliance a rogue Russian state that effectively pegs household bills to the coercive whim of Vladimir Putin.

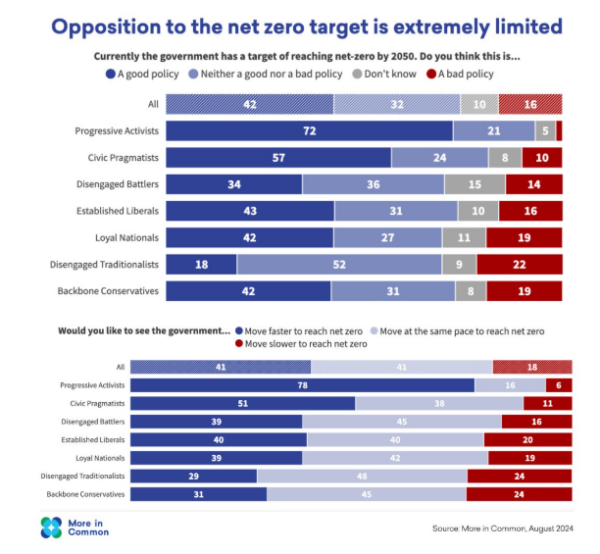

As the poll below, compiled by “More In Common”, opposition to the government’s net zero target is a minority position across every segment of the electorate. Even Reform and Conservative voters can see that green investment will have a positive impact, helping to grow the economy and reducing the cost of living.

Indeed, in Farage’s own constituency, Clacton-on-Sea, 68% said they were “somewhat” or “very” worried about the issue.

Readers may remember that, after winning the July 2023 Uxbridge byelection by campaigning against plans to extend congestion charging to the capital’s outer suburbs, the Tories thought they had a template for attacking Labour as a party of anti-motorist ecowarriors. Instead, they found themselves pilloried for reneging on Britain’s international climate commitments.

The Tories, who are expecting wholesale defeat in the forthcoming elections, are a lost cause, they will jump on any right-wing, anti-Labour issue that comes along

‘The Tories, who are expecting wholesale defeat in the forthcoming elections, are a lost cause’

Should, as is predicted, Reform have a successful night, then Starmer must resist calls to bend on climate change as a way of fending off Reform’s agenda. Polls show the public is concerned about climate change, and he doesn’t need to risk splitting the left-wing vote in marginal seats with either the LibDems or Greens.

Over in the US, Trump the full espresso to Farage’s decaf version

During his first term in 2017-2021, Trump rolled back climate regulations and pulled the US out of the Paris Agreement, a move he has promised to repeat.

During campaigns for the 2024 election, he continued to attack climate action and science, leaning heavily on his mantra of “drill, baby, drill”, as well as announcing he wanted to “terminate” spending on what he calls the “green new deal” – understood to be a reference to 2023’s landmark Inflation Reduction Act.

However, unlike decaf Nigel, when it comes to economy Trump is fully engaged, perhaps too much so!

I say this as a report by the IMF says that his tariffs have unleashed a “major negative shock” into the world economy. As a result they have cut their forecasts for US, UK and global growth. The report warns of a non-negligible risk of a $1tn hit to global output, as Donald Trump’s erratic “America first” agenda – part oligarchic enrichment scheme, part mobster shakedown – collides with a perfect storm of global financial vulnerabilities.

‘his tariffs have unleashed a “major negative shock” into the world economy’

The Washington-based lender expressed particular concern about the growing role of “nonbank” lenders, which are much less heavily regulated than banks, but can still pose risks to the wider financial system. Nonbank lenders include pension and investment funds, has grown rapidly post-2008, after bank regulation increased after the GFC.

It is likely that nonbank lenders will be forced to divulge more information to regulators, which could then identify and rein in “poorly governed and excessive risk-taking institutions”.

High levels of borrowing by these nonbank lenders also “imperils market functioning”, the IMF said, noting these investors had amplified a recent sell-off in US government bonds due to pressure to meet margin calls, when investors are required to post collateral to cover losses.

Borrowing by hedge funds could also “exacerbate losses” during periods of market turmoil, the IMF said. At the hedge funds that make big macroeconomic bets, leverage can be as high as 40 times the value of their assets, the report found.

The report also flagged potential contagion risk in the private credit fund system, which it said could “spread credit shocks across institutions and countries”.

More companies are borrowing from private credit funds, it said, and big investors such as pension funds are increasingly backing foreign direct-lending funds.

Returning to global trade, the IMF said: “We expect that the sharp increase on 2 April in both tariffs and uncertainty will lead to a significant slowdown in global growth in the near term.”

The timing of this is hardly ideal with chancellor Reeves meeting her US counterpart, Scott Bessent, for the first time to press the UK’s case for reduced tariffs. She said she would be “defending British interests and making the case for free and fair trade”.

The Washington-based institution has cut its forecast for global GDP growth to 2.8% for this year – 0.5% weaker than it was expecting as recently as January, based on the current trade policy, “intensifying downside risks dominate the outlook”.

Its forecasts show every major economy being hit, with the UK expected to grow by 1.1% this year, down from 1.6% predicted in January. The IMF expects a sharper deterioration for the US, from 2.7% to 1.8%, and said the probability of a recession in the US had increased to nearly 40%, higher than its forecast of 25% made in October, the month before Trump’s election victory.

The IMF said that even after Trump’s “pause”, which suspended punitive “reciprocal tariffs” on a string of countries, trade barriers were at the highest level in a century.

Ahead of the finance ministers meeting , the IMF called for coordinated action to reduce trade tensions, restructure low-income countries’ debts, and “address shared challenges”. It is unclear what role the US could take in any such discussion, however, given its commitment to an “America first” approach.

Whilst comparisons with 2008 are inevitable that was a market-related crash, this time around there is the addition of political risk at the heart of the dollar system.

Ominously, the IMF draws the comparison, first made by the analyst Nathan Tankus, with the “dash for cash” in March 2020 during Covid, when the Fed rescued US treasury markets directly. They are concerned that developing nations, already struggling with the highest real borrowing costs in a decade, may now be forced to take on even more expensive debt just to cushion the blow from the new tariffs, risking a dreaded “sudden stop” in capital flows.

‘what we are seeing in the US is investors hedging against political chaos, rather than inflation or growth’

Previously, the US was always seen as the country that underpinned global financial architecture. Just over a week ago, Adam Tooze of Columbia University wondered if markets had begun to “sell America” after US long-maturity bond prices fell precipitously. He thought that markets were no longer just responding to economic fundamentals but to politics as a systemic risk factor – Trump’s tariff threats and his increasing political pressure on Fed’s chair, Jerome Powell.

Political stability underpins a country’s finance; what we are seeing in the US is investors hedging against political chaos, rather than inflation or growth. The IMF, as a central bank, is being diplomatic, the report contains blunt systemic warnings, whilst comment from their officials are trying to calm markets, so as to avoid further panic in treasuries and the dollar.

The unspoken, but real concern here is about the politicisation of the monetary-fiscal connection under a Trump regime that is fundamentally hostile to the norms of liberal-democratic governance.

Elsewhere other events aren’t looking so good for Trump.

The European Commission has fined Apple €500m and Meta €200m for breaking rules on fair competition and user choice, the first penalties issued under one of the EU’s landmark internet laws.

The fines under the EU Digital Markets Act (DMA), which is intended to ensure fair business practices by tech companies, are likely to provide another flashpoint with Trump’s administration, which has fiercely attacked Europe’s internet regulation.

Elsewhere, his efforts to create what he describes as peace in Ukraine are stalling, and Russia continues to prosecute the war.

It is reported that Putin had offered to freeze the conflict in Ukraine along the current frontlines. The Ukraine, understandably don’t want to cede territory to Russia, as a result Trump is blaming them for talks breaking down.

Apparently, Russia is willing to trade territory it does not control in Ukraine for a US recognition of its 2014 seizure of Crimea, in other words a formal acknowledgment that it is possible to change borders by force.

‘a formal acknowledgment that it is possible to change borders by force’

There remains uncertainty as to what other demands Putin might present, and there are concerns that the apparent concession could be a tactic to draw Trump into accepting broader Russian terms.

Initial indications suggest Russia is willing to trade territory it does not control in Ukraine – in effect, fresh air – for a US recognition of its 2014 seizure of Crimea, in other words a formal acknowledgment that it is possible to change borders by force, in effect creating an extraordinary post-second world war precedent.

At home, opposition to Trump is growing.

Earlier this month the Senate voted 51-48 to strike down “the national emergency” allowing tariffs on imports from Canada; 4 Republican senators, Lisa Murkowski, Mitch McConnell, Rand Paul and Susan Collins joined every single Democrat to try to dismantle a major piece of Trump’s trade war.

There are numerous cases against the Trump regime, the following link allows you to track their progress:

The US is a lesson we can learn from. Their equivalent of the red wall is the rust belt, both have never recovered from 1980s deindustrialisation. Both have every right to feel forgotten by previous administrations, but voting for a disruptor is like breaking something in-temper; it feel great until the reality of the damage sets in.

“The time is now, it’s running out

It’s running out, it’s running, running, running out”

‘Perhaps this piece should have been entitled “A Warning From America”, as our own ersatz version of Trump continues to gain in popularity.

The Tories are down and possibly out. They have finished in third place in every YouGov voting intention poll so far this year, with this week’s suggesting that 20% of voters who backed the Tories in 2024 have now switched to Reform. Labour, by comparison, has lost 11% of its general election vote to Farage’s party.

Robert Jenrick seems to see the future as some sort of pact, coalition, merger with Reform, much to the disgust of leader Badenoch. As leader Badenoch is woeful, banging on about culture wars ad nauseum and totally missing the financial problems the government is facing.

Farage has been adamant that there will be no cooperation with the Tories; why should he? He’s winning.

Perhaps some success at the local level might derail the Reform bandwagon. It would leave them facing full public scrutiny, and people might start to see that they are swimming naked.

I ended the piece by comparing the red wall with the rust belt in the US. Clearly both have suffered post-deindustrialisation and have been let down by mainstream parties and politicians. Neither Trump nor Farage have the answers to their problems, ironically the person who did could have been Joe Biden.

His Inflation Reduction Act encouraged and incentivised green business. In turn, it achieved two things; transitioning the economy to sustainability and incentivising businesses to locate to rundown areas. Unfortunately, this ship will take time, maybe 10yrs to turn round, and no one gave him that.

People should remember disasters happen quickly, recovery takes time and costs money!

Lyrically, a hardcore piece deserves hardcore, we open with “Minor Threat” by Minor Threat, and end with “Bad Mouth” by Fugazi. Ian MacKaye, who founded both bands, was well-known for his dislike of Reagan, one can only wonder what he makes of Trump.

Enjoy!

Philip.’

@coldwarsteve

Philip Gilbert is a city-based corporate financier, and former investment banker.

Philip Gilbert is a city-based corporate financier, and former investment banker.

Philip is a great believer in meritocracy, and in the belief that if you want something enough you can make it happen. These beliefs were formed in his formative years, of the late 1970s and 80s

Leave a Reply

You must be logged in to post a comment.