May

2025

I’m So Bored With the USA: The Times They Are A-Changin’

DIY Investor

10 May 2025

“And you better start swimmin’

“And you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’”

We start this edition in the US, or, more accurately, Trump’s attitude to foreign policy

Readers might remember that two of Trump’s foreign policy pledges were to the end the wars in Gaza and Ukraine. Whilst neither has yet been resolved he seems to have moved on from Gaza, perhaps through boredom, or seeing more upside in exploiting Ukraine’s mineral wealth.

Either way, the position was neatly summed-up by Amos Harel, military and defence correspondent for Haaretz: “Part of the tragedy is that the only one who can actually save us, Trump, is not even seriously interested in that. Our only hope to get out of this crazy situation is that Trump would force Netanyahu to reach a hostage deal. But [Trump] seems disinterested. He was enthusiastic when the Riviera [idea] was proposed, but now he has moved on to Greenland, Canada and Mexico instead.”

Short-termism appears to be a growing trend with this White House: broad designs for a grand deal followed by frustration when diplomacy fails to yield instant results.

We saw something similar when the administration said it would leave negotiations over the Ukraine if a quick deal was not achieved. This incentivized Russia to play a long game, banking on the US disengagement. Netanyahu similarly appears to have been unleashed by the White House’s growing disinterest.

Trump’s enthusiasm for turning Gaza into a “Riviera of the Middle East” have provided cover for right-wing Israeli politicians to enthusiastically support the forced resettlement of the Palestinian population. Israeli hardliners have been particularly aggressive; finance minister Bezalel Smotrich saying that within months Gaza would be “totally destroyed” and the Gazan population would be “concentrated” in a small strip of land. “The rest of the strip will be empty”.

For those trapped inside Gaza the situation is becoming increasingly desperate, no food or medical supplies have entered for nine weeks, and Israeli forces have now seized about 70% of the territory as military buffer or civilian no-go zones, pushing 2.3 million people and aid operations into ever-smaller areas – which are no longer designated as “humanitarian zones”.

Rafah, on the Egyptian border, was Gaza’s lifeline to the outside world, but is now under total Israeli control, turning the strip into an enclave enveloped by Israeli territory (“Whoever controls Rafah controls Gaza,” as a former Israeli general put it).

Trump has broken a decades-old taboo by suggesting Palestinians should leave, rather than holding the line on the traditional two-state solution. Trump, however, upended this norm and his own ceasefire deal in February by suggesting the only “viable plan” for Gaza is for its population to leave and the strip rebuilt as the “riviera of the Middle East”.

‘Trump has broken a decades-old taboo by suggesting Palestinians should leave’

Whether it becomes a holiday resort or not, the expulsion of the Palestinian population has been widely condemned as a blueprint for ethnic cleansing.

Domestically, Trump is experiencing economic problems that sound familiar to the UK’s.

As with the Conservatives from 1979 onwards, Reagan’s America followed neoliberal economic theory, with high-income tax cuts became the Republican party’s economic policy priority. In both instances these gifts to the wealthy were sold as a benefit to the working class.

Reagan, George W Bush and Donald Trump each championed tax cut legislation that delivered disproportionate benefits to the rich, fuelling an explosion in inequality, whilst pretending to be populists fighting for the masses.

Over this period they performed, what might be described as a conjuring trick, cutting taxes on the wealthy without pursuing correspondingly deep austerity measures. Public debt has made up the difference, or in the words of Dick Cheney in 2003: “Reagan proved deficits don’t matter”.

In 2017, Trump as he prepared to sign his $1.9tn tax cut bill, said: “I promised we would pass a massive tax cut for the everyday, working American families who are the backbone and the heartbeat of our country. “We’re just days away [from] keeping that promise and delivering a truly amazing victory for American families. We want to give you, the American people, a giant tax cut for Christmas.”

All this did was make the rich richer and the poor poorer

Polls show that the US electorate have become less and less enthusiastic about tax cuts. Whilst over 50% approved of Reagan’s first major high-income tax cut proposal, C. a third approved of Bush’s similar tax proposal. By the time Trump assumed his first term, less than a third of Americans supported his high-income tax cut initiative, knowing that such policies have failed to benefit them personally and failed to boost the macroeconomy.

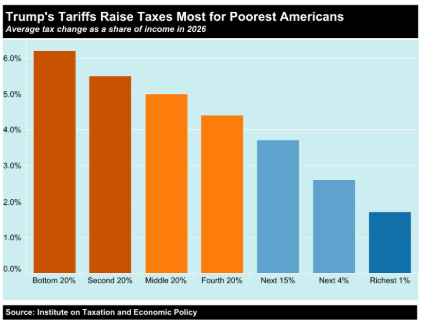

It is unlikely that Trump’s new $4.5tn proposal to extend his 2017 tax cuts will be received anymore enthusiastically by the majority, if, as expected the initiative delivers more than half its benefits to the richest 10% of the country. Coupled with spending cuts and tariffs, Trump’s agenda would deliver a big income boost to the top 1%, while reducing the income of the bottom 80%, according to the Centre on Budget and Policy Priorities.

This was endorsed by new Institute on Taxation and Economic Policy, which shows that Trumps tariff proposals would raise taxes for all income groups, with the biggest impact on the poorest. The analysis covers the impact of Trump’s proposed tariffs, his taxes on imported goods that will likely be passed on to consumers.

Opposition to the proposal is not just among Democrats and independents, but also among Republicans. Morning Consult reports that 70% of Republican voters believe “the wealthiest Americans should pay higher taxes” – an eight-point jump from six years ago. Moreover, “roughly 70% of voters, including 2 in 3 Republicans, support proposals to raise taxes on earners making more than $400,000.”

As a result, Republican leaders, including Trump, are considering the previously unthinkable: raising some taxes on the rich and creating a new top tax bracket.

‘Republican leaders, including Trump, are considering the previously unthinkable: raising some taxes on the rich and creating a new top tax bracket’

The proposal itself is a brainchild of the conservative American Compass thinktank, which, in a June 2024 white paper, proposed raising taxes upon the wealthy to pay down the American national debt. “The constituency and base of the Republican party is shifting,” Oren Cass, American Compass’s founder, told the Atlantic in April. To extend Trump’s 2017 tax cuts by simply adding $5tn to the American national debt would be, in Cass’s words, “pathetic, embarrassing, and outright cheating”.

Steve Bannon, the former White House Chief Strategist shares Cass’s concerns over the misalignment between the Maga movement’s populist posture and its upwardly redistributive governance, saying: “This is a 1932-type realignment, if we do this right. You have to break that mindset that stock buybacks are fine, that crony capitalism is fine, and the tax breaks for the corporations are fine, then you’re going to squander a unique moment in history.”

Like all conjuring tricks, there is a moment when people fail to see the illusion. The size of the deficit is fast reaching the terminal stage will very much matter. As I wrote in “No One Wants to Pay”, someone has to, be it the wealthy or the masses. Will it be Trump’s courtiers the tech barons, or his increasingly working-class voter base?

Trump will soon have to choose between taxing the top or deeper austerity for the bottom.

At this point let’s dispel the theory that raising taxes forces the wealthy away.

Both Massachusetts and Washington recently adopted higher taxes on high earners. The number of millionaires in those two states actually increased after this: in there has been a 38.6% increase in millionaires since 2022. (1)

In the UK, chancellor Reeves has the same dilemma.

The National Institute of Economic and Social Research (NIESR) said the UK was on course to suffer a long period of stagnation, cutting tax receipts and forcing the chancellor to balance the books only months after a tough budget in March that reduced welfare benefits.

It predicted the UK economy will grow by 1.2% in 2025, down from a previous forecast of 1.5%, “amid low business confidence, high uncertainty and rising cost pressures”. Adding that the prospect of further tax rises in the autumn were having a more negative impact on business investment than the uncertainty surrounding Donald Trump’s tariff threats.

‘low business confidence, high uncertainty and rising cost pressures’

NIESRs UK economist, Benjamin Caswell, said manifesto pledges to keep day-to-day government spending in balance while also bringing down the overall of level of debt as a proportion of GDP, within the five-year parliament prevented the Treasury from increasing levels of borrowing and skewed tax rises away from households to businesses were harming economic growth.

NIESR said the annual deficit, which is currently capped at £9.9bn, could rise to £62.9bn in 2029-30, forcing ministers to either increase borrowing or make further spending cuts.

Overall debt will rise from 88.8% of GDP to 89.5% of GDP under a new measure of borrowing – Public Sector Net Financial Liabilities (PSNFL) – that includes government assets to reduce the UK’s debt position.

In summary, the thinktank’s analysis suggests that a further round of budget cuts will be needed in the autumn.

This coming only a day after the release of a negative YouGov Westminster voting intention poll is likely to alarm Labour MPs. The poll put Reform on 29%, Labour on 22%, the Conservatives on 17%, the Liberal Democrats 16%, and the Greens 10%.

The Conservatives were last at 17% in June 2019, in the aftermath of the European parliament elections shortly before Theresa May was ousted, while the result is Labour’s lowest since October 2019, under Jeremy Corbyn.

Labour’s problem is that they simply fail to see the problem.

‘Labour’s problem is that they simply fail to see the problem’

Their response to a poor election day last week was extra funding to spruce up GP surgeries and a possible crackdown on student visa applications. Something that might have resonated with voters such as rethink on means testing the winter fuel payment for pensioners was quickly denied. The cost of living seems to have completely passed them by.

This is somewhat of a legacy issue for the party.

When Blair became PM in 1997 he accepted the devastating economic changes made in the 80s under Thatcher. Within this the role of unions went from furthering workers rights to helping retrain them for the jobs of the future.

Blue-collar manual jobs would be replaced by white-collar jobs in the growing services sector. Expanding higher education would increase the supply of graduates and lead to rising demand for better-paid jobs. We would all be middle class. And, for a while, into the early 2000s steady growth encouraged this fantasy, as a result politics became dominated by “identity politics”, as concerns about jobs, wages and living standards fell away.

The reality has proved somewhat different.

The closure of factories and mines did not spell the end of working-class communities, and the need for well-paid unionised working-class jobs didn’t disappear either. However, all these people were left with was lower-paid, non-unionised jobs in warehouses and call centres.

Many of the new university graduates ended up in these dead-end jobs, feeling they had been over-promised and unwarded for their efforts.

‘Many of the new university graduates ended up in these dead-end jobs’

In effect, the dream of perpetual and universal prosperity was just that, a dream, shattered by the GFC. Since 2008, for many we have an L-shaped recession, with many families struggling to make ends meet. More than half the children in poverty live in households where the parents are working, leaving them vulnerable to rising interest rates, higher energy bills and dearer food bills.

The electorate, many of who are impacted, understand this, which explains why there has been sympathy for striking workers seeking to defend their living standards, and support for state ownership.

One of the results of the white-collar revolution was the north-south divide. While all regions have their prosperous enclaves, it is the SE that dominates; GDP per head in London is more than double its level in the NE. Only in London and the SE is GDP per head above the national average.

All of this has given rise to that electoral phenomenon, the red wall, which after being a Labour stronghold, fell for Johnson shtick in 2019. Labour are possibly on their last chance in these constituencies, with Reform the likely beneficiary.

The situation in the more prosperous south is the same but different; a four-way battle involving Labour, the Conservatives, the LibDems and the Greens. Voters concerns are different: rejoining the EU, support for net zero, and more openminded on immigration.

In effect the divide could almost be two different countries.

‘The country is broken, structurally as well economically’

The Tories, facing possible extinction, are unloved by both, whilst Labour is finding itself squeezed from left and right.

The diagnosis is simple, fix the economy, the treatment is somewhat more difficult, or perhaps the medicine is simply unpalatable.

The country is broken, structurally as well economically. The situation is not unlike the US; to achieve levelling-up, dealing with inequality will be expensive. But, there are choices, there always are.

We deal with the problem, which means higher taxes. Or, if no one wants to pay, we can have more austerity, or continue with declining public services – as I have written many times, “you can have the NHS you want, or the one you are prepared to pay for. But, you can’t have both”.

If we don’t fix it now we face another lost generation, as the barbarians of Reform, will shrink the state (services), cut taxes, and, the red wall will have been let down once more. After all, what good is zero immigration when you can’t feed the kids?

“But I just saw him eat off the food we waste

Civilization, are we really civilized, yes or no

Who are we to judge

When thousands of innocent men could be brutally enslaved

And killed over a racist grudge”

Notes:

- The Institute for Policy Studies and State Revenue Alliance, April 28th 2025

‘So much of what we are seeing is, unfortunately, how I saw things playing out.

With hindsight Brexit was the warning sign, the perceived traditional voters alliances we all coming apart. What it spelled could be deemed the beginning of the fend of the neoliberal economic experiment that started in 1979-80.

It was a two-pronged attack; it started with Thatcher breaking inflation, the unions, uncompetitive industry, progressive taxation.

This was followed by the Blair years when it was expected we would have a highly educated, highly paid workforce. For a while it worked, and politicians assumed that inflation, and the traditional boom and bust cycles were behind us, replaced by “the goldilocks economy”. Politics then focussed on people and progressive issues.

What changed everything was the neoliberalism death knell, the GFC.

Next week I plan to explore the costs of the two black swan events, the GFC and Covid, and the two political disasters of Brexit and the Truss budget.

The real victims of these four events are the masses, most of whom have been in an L-shaped recession for the last 17-yrs.

In my view the only way out is higher taxes, there is little left to cut. This is why the noises coming from the US are so interesting. If Trump bows to his MAGA elector base taxes are his get out of jail card. If the US can do this, so can we.

As Bob Dylan sang, “The Times They Are A-Changin’”, and this is today’s opening track. We finish on a different note with “Mr. Wendal” by Arrested Development. Larry Flick from Billboard described “Mr. Wendal”: “Once again, lyrics that realistically reflect the strife and struggle of survival during these racially tense times are woven into an easy-going pop/hip hop groove.”

Always remember, someone has to pay!

Philip’

@coldwarsteve

Philip Gilbert is a city-based corporate financier, and former investment banker.

Philip Gilbert is a city-based corporate financier, and former investment banker.

Philip is a great believer in meritocracy, and in the belief that if you want something enough you can make it happen. These beliefs were formed in his formative years, of the late 1970s and 80s

Leave a Reply

You must be logged in to post a comment.