Sep

2025

Investing Basics: Investing in commodities with investment trusts

DIY Investor

20 September 2025

We explore why investing in commodities via investment trusts helps to deliver long-term growth prospects and a diverse portfolio for keen investors…by Jo Groves

It may be more than 6,000 years since commodities were first traded but they still sit at the heart of the global economy, with Statista reporting that an estimated $140 trillion in interests will change hands this year alone.

Commodities remain an indispensable part of our daily lives, from the oil and gas heating our homes to the lithium-ion batteries powering our smartphones and electric cars. More recently, geopolitical tensions have heightened concerns around national energy security, while the rapid adoption of energy-intensive AI technologies is driving a significant increase in demand.

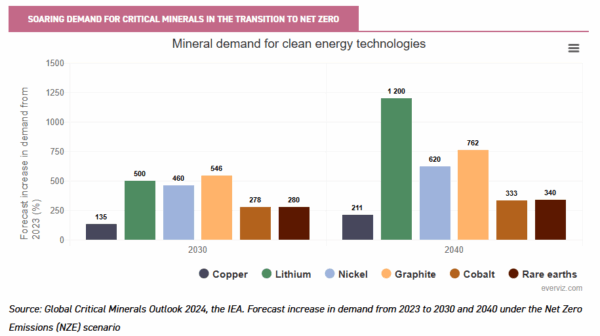

Looking ahead, commodities are poised to play a pivotal role in the clean energy transition, with the International Energy Agency (IEA) forecasting that demand for critical minerals could triple by 2040. Minerals such as lithium, nickel and cobalt are critical components in battery production, while electricity grids, which form the backbone of the renewable energy transition, will require substantial quantities of copper and aluminium.

Beyond their practical applications, commodities provide investors with valuable diversification beyond traditional equities and bonds, as well as protection during periods of rising inflation. Despite these benefits, commodities are often under-represented in investors’ portfolios.

What drives the price of commodities?

Commodities are broadly categorised into two groups:

- ‘Hard’ commodities: extracted or mined resources including energy (oil, natural gas and coal), precious metals (gold, silver and platinum), and industrial metals (copper, iron ore and lithium).

- ‘Soft’ commodities: agricultural or livestock products such as corn, coffee, soybeans, wheat, meat and cotton.

Rakesh Jhunjhunwala, often hailed as the Warren Buffett of India, is quoted as saying, “In commodities, when prices go up, demand goes down. In stocks, when prices go up, demand goes up.” While commodity prices are largely a function of demand and supply, the dynamics can vary significantly by the type of commodity.

Energy commodities are strongly influenced by economic cycles and geopolitical factors, with OPEC actively managing oil production. Precious metals command high valuations due to their finite supply and sustained demand across both industrial uses and consumer applications, while industrial metals are closely linked to manufacturing cycles, as well as the global transition toward clean energy. Agricultural commodities face unique supply and demand dynamics, including adverse weather such as floods or drought, technological advances and government support.

Why invest in commodities?

There are a number of reasons to invest in the commodities sector, which we explore in more detail below.

1. Strong drivers of demand

Commodities are forecast to enjoy strong secular growth drivers as the critical building blocks in the clean energy transition.

As illustrated in the graph below, the IEA is projecting a five-fold increase in demand for lithium from clean energy technologies by 2030 (and a 12-fold increase by 2040), with electric vehicles and battery storage accounting for 90% of total demand. This is accompanied by robust growth in other battery minerals such as nickel, cobalt, manganese and graphite.

Another key driver of growth is the pressing need to upgrade global energy infrastructure. Copper plays a critical role in power transmission networks and clean energy technologies such as solar panels and wind turbines, with the IEA forecasting that copper demand will double by 2030. In addition, rare earth elements are essential for the magnets used in wind turbines and electric motors.

As a result, governments have earmarked substantial funds for investment in low-carbon technologies, including almost $400 billion under the US Inflation Reduction Act (IRA) and €270 billion by the EU.

The rapid expansion of energy-intensive data centres is also expected to drive substantial demand for commodities. On average, processing a ChatGPT query consumes ten times more electricity than a Google search and a recent study warned that the AI industry could consume as much energy as a country the size of the Netherlands by 2027.

This trend has led major technology firms such as Amazon, Alphabet and Microsoft to explore nuclear power solutions, which could boost demand for uranium.

2. Persistent supply constraints

Supply constraints remain a challenge across the commodities sector, with production limited by factors such as declining ore grades, ageing infrastructure, long lead times for new mines, geopolitical issues and a lack of investment in new capacity.

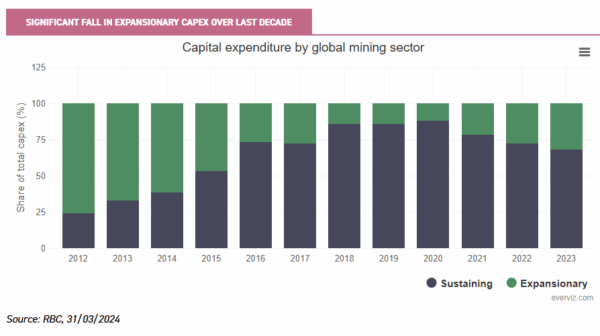

As illustrated in the following chart, expansionary capital expenditure has significantly fallen over the last decade as mining companies have prioritised debt repayment over new investment, resulting in strong balance sheets and lower leverage compared to historical averages and other sectors.

A lack of shovel-ready projects and a substantial rise in the cost of new projects mean that current supply constraints are likely to persist, which should be supportive of commodity prices going forward. There has also been a notable uptick in M&A activity as mining companies look to acquire assets trading below replacement costs, which may provide a further tailwind for returns.

3. Portfolio diversification

Commodities provide the opportunity to diversify into a different asset class to equities, bonds and property. Historically, commodities have had a low correlation to equities, meaning that commodities have generally outperformed when equities have underperformed.

This low correlation was particularly valuable when bonds and equities fell sharply in 2022. By way of example, investors in BlackRock World Mining (BRWM) would have enjoyed a share price total return of 26% in 2022, compared to a negative return of 38% and 19% in the UK index-linked gilt market (using an iShares ETF as a proxy) and S&P 500 indices respectively.

However, while the share prices of mining companies have often displayed a low correlation to broader equity indices, it should be noted that they can be highly correlated at other times.

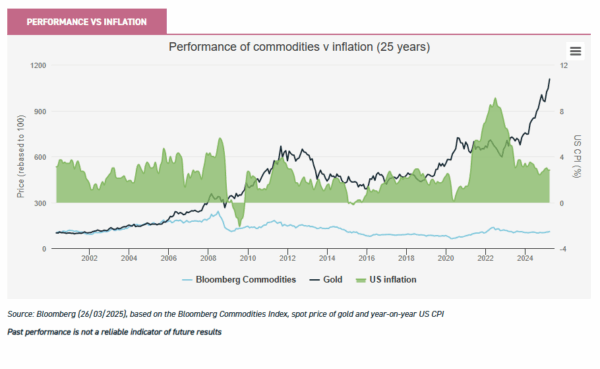

Commodities can also act as a hedge against inflation as prices generally rise during times of inflation, with commodity prices often included in inflation calculations.

The following chart shows that the broad-based Bloomberg Commodity Index rose when US inflation exceeded 4% in 2008 and 2022. Gold has also often performed strongly in times of rising inflation, as seen in the period following the global financial crisis. Given the potential inflationary impact of US tariffs, this could provide a useful protection mechanism for investors.

4. Track record of attractive returns

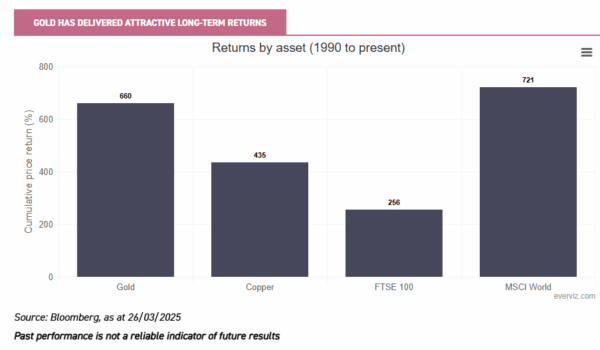

Commodities have historically delivered strong returns over the long term, although they can be volatile over shorter time periods.

The following chart shows the price returns from a selection of commodities and indices. Gold and copper have delivered returns of 660% and 435% respectively, significantly outperforming the returns from the FTSE 100 Index.

Gold has delivered a particularly strong performance in recent years, reaching record highs amid macroeconomic uncertainty and escalating geopolitical tensions. A key driver has been increased purchasing by central banks, particularly in China, as they seek to reduce their reliance on US dollar reserves.

Why invest in commodities via investment trusts?

It’s worth saying at the outset that it’s difficult to invest directly in physical commodities other than precious metals. However, the latter incurs a cost in terms of secure storage and insurance and jewellery typically has a high markup on the underlying value of the metal. Another option is futures contracts but, due to their volatility, these are suitable only for professional traders.

Investment trusts offer a practical solution by providing exposure to a diversified portfolio of commodities managed by experienced professionals. An active approach enables trusts to research the best opportunities in a broad and complex universe rather than investing indiscriminately across the sector.

Trusts will generally invest principally in the equities of mining and exploration companies rather than directly in the underlying commodities. While the share prices of mining companies are typically less volatile than the underlying commodities, returns from mining equities can diverge from commodity prices.

There are currently seven trusts specialising in the AIC Commodities and Natural Resources sector on the London Stock Exchange. The scope varies by trust, with some trusts investing in specific areas and others across commodities more broadly.

Investment trusts v open-ended funds

It’s fair to say that some of the benefits mentioned above, whether a diversified portfolio or manager expertise, also apply to open-ended funds but investment trusts have some unique attributes, which may help them deliver superior returns compared to their open-ended peers.

Firstly, open-ended funds are not publicly traded (unlike investment trusts), meaning that the size of the investable fund will rise and shrink with the purchase and sale of units in the fund. As a result, open-ended funds typically hold a significant proportion of cash in reserve to meet redemption requests, which can create a drag on returns.

As publicly traded companies, investment trusts do not have this problem, as the buying and selling of shares in the investment trust does not affect the size of the investable fund. Trusts are not required to retain cash for redemptions, which can boost returns for investors and allow longer-term investment in less liquid and private investments, including pre-IPO companies and private market royalty investments. On the other hand, trusts may trade at a discount to net asset value, meaning that the share price may underperform relative to the underlying net asset value of the portfolio.

Trusts can also deploy gearing, which has the potential to enhance returns (although it can also augment losses on the downside), as well as using capital reserves to pay dividends.

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by BlackRock World Mining (BRWM). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Financial Education » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.