Aug

2025

Investing Basics: Investing in frontier markets with investment trusts

DIY Investor

30 August 2025

How investment trusts provide exposure to the dynamic growth story of frontier markets…by Jo Groves

Sir John Templeton observed: “In investing, what is comfortable is rarely profitable.” Emerging markets demonstrate this better than most: once a contrarian bet against the perceived safety of developed economies, they now account for 45% of global GDP and more than half the world’s population. Their weight in global equity markets has also risen, with Goldman Sachs projecting a 55% share by 2075.

However, what was once unconventional is now mainstream, with rising correlations blunting the diversification benefits of emerging markets. The next contrarian chapter may lie in frontier markets, which share the same appealing traits of rapid growth, youthful demographics and urbanisation, but remain largely untapped by institutional and private investors.

We take a closer look at the investment case for frontier markets as a dynamic and growing part of the global investment universe.

What are frontier markets?

The term was coined in the 1990s by the International Finance Corporation (IFC) to describe smaller, less liquid markets that are typically at an earlier stage of economic and financial development than emerging markets. However, some developed countries, such as Iceland and Bahrain, are included due to their smaller size and/or trading restrictions.

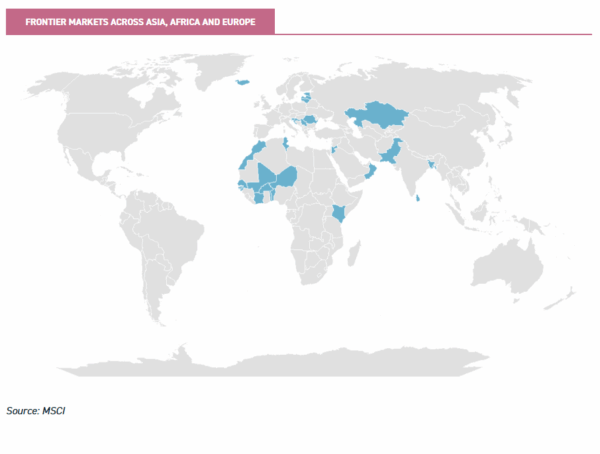

Classification systems vary but the MSCI considers all equity markets not included in the MSCI Emerging Markets Index that demonstrate openness and accessibility for foreign investors, excluding countries from the developed market universe and countries with extreme economic or political instability.

This leaves a universe of 28 countries in the MSCI Frontier Markets Index (as shown in the map below), although some funds will include ‘off-benchmark’ geographies from smaller emerging markets with similar characteristics.

Why invest in frontier markets?

The draw of frontier markets lies in their combination of growth opportunities and relatively low correlation with developed markets. We look at the key drivers in more detail below:

An economic powerhouse

A key attraction of frontier markets is the exposure to smaller, faster-growing economies with a longer runway for growth.

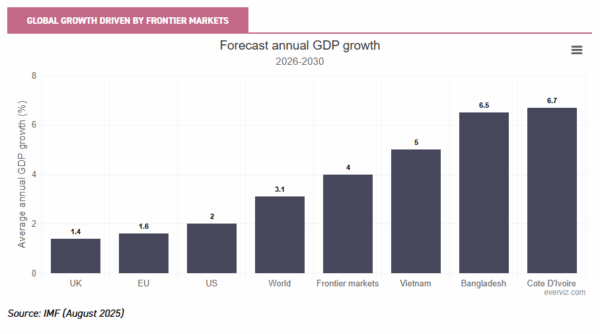

As shown below, frontier markets are set to grow at twice the pace of North America and the EU over the next five years, with average annual GDP growth of 4% versus 2% and 1% respectively. Several economies, including Vietnam, Bangladesh and a cluster of fast-growing African nations, are forecast to exceed 5% a year.

Another powerful tailwind is the ‘demographic dividend’ of a young and growing population, with almost one billion people located in frontier markets, in contrast to the shrinking (and ageing) populations of many developed economies. Rising disposable incomes are also creating a burgeoning consumer class, providing domestic demand to complement export-led growth.

Frontier markets have also gained from the ‘China Plus One’ strategy, as multinationals diversify supply chains amid geopolitical tensions. Easing regulatory and trade barriers have accelerated foreign investment, with Apple, Samsung and Nike expanding in Vietnam, while Bangladesh has become a textiles powerhouse, exporting to global brands such as H&M and Zara.

Vietnam epitomises the frontier story: a fast-growing economy and stock market representing a quarter of the MSCI Frontier Markets Index, with over 700 listed companies and daily trading volumes exceeding $1bn.

Uncovering hidden gems

Companies in frontier markets often receive little to no analyst coverage and publicly available information can be scarce. This lack of scrutiny can create pricing inefficiencies with valuations that fail to reflect a company’s true growth potential.

Active fund managers who carry out their own on-the-ground research are well placed to identify such opportunities and generate meaningful alpha for investors. Similarly, those willing to invest early may be rewarded as frontier markets mature and attract greater allocations from both retail and institutional investors.

A rich source of diversification

Frontier markets offer investors a distinctive source of diversification. Domestic dynamics often play a larger role than global macro trends, enabling markets to evolve with relative independence from the wider global economy. With limited institutional ownership, they are also less exposed to the powerful tides of global active and passive fund flows than emerging or developed markets.

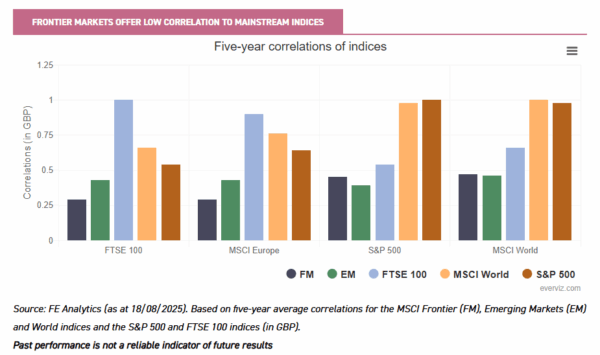

As a result, frontier markets tend to display a relatively low correlation with both emerging and developed markets, which can help to improve diversification. As shown in the chart below, frontier markets have low correlations to leading US, UK, European and world indices (with zero representing no correlation and one representing a perfect positive correlation).

By comparison, emerging markets tend to exhibit higher correlations, particularly with European and UK indices, reflecting their increasing convergence with developed markets in recent years.

As with emerging markets, there is also significant heterogeneity within frontier markets themselves, offering an additional layer of diversification. And while there is a common perception that frontier markets are more volatile, in fact the MSCI Frontier Markets Index has displayed lower volatility over the past three, five and ten years than the MSCI Emerging Markets, US and World indices (as at 31/07/2025).

Taken together, low correlations and lower historical volatility suggest an allocation to frontier markets within a broad global portfolio can help reduce overall portfolio risk while adding exposure to faster-growing economies.

Attractive valuations

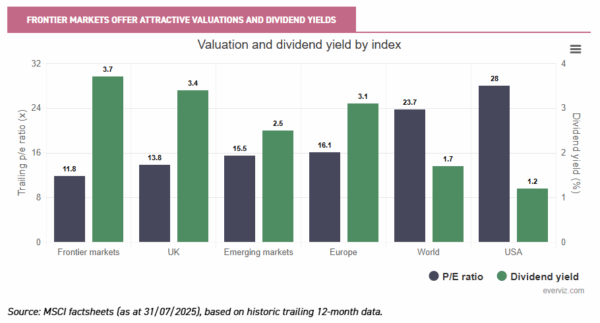

Frontier markets are currently trading at a significant discount to their emerging and developed market peers, as shown in the chart below. They are currently trading at a 25% discount to emerging markets and a 50%-plus discount to the MSCI US and World indices. Given the strong secular growth drivers, we think there could be the potential for a re-rating in valuation as frontier markets mature.

They also offer an attractive income story, with a dividend yield above even the UK and Europe, which traditionally appeals to income-seekers. This income cushion can play an important role in supporting total returns, although dividend policies are not always as consistent as in developed economies.

How difficult is it to invest in frontier markets?

Frontier markets can be challenging for investors to access due to constraints on foreign ownership of companies, currency controls and lower liquidity. This makes it difficult for investors to buy equities in frontier markets and none of the three major retail investment platforms currently offer access to these equity markets.

In addition to limited market access, it can be hard to evaluate investment opportunities in frontier markets due to a lack of public information. Companies may have little third-party coverage in the media, reports that are not available in English and no analyst coverage. A strong understanding of the country-specific political and economic environment is also a prerequisite for investment.

Private investors looking to invest in frontier markets will therefore face significant hurdles in terms of market access and evaluating potential investments with limited information.

Investing in frontier markets using investment trusts

Investment trusts are a type of fund that enables investors to gain broad exposure to frontier markets, while managing the risks mentioned above. Investors can buy and sell shares in trusts listed on the London Stock Exchange, providing a ready-made diversified portfolio of companies.

Fund managers can overcome the hurdles of investing in frontier markets, such as navigating the bureaucracy of buying and selling shares and managing factors such as liquidity and currency risk that would be cumbersome and expensive for private investors.

They are also able to access a deeper pool of resources to analyse the large equity universe in frontier markets, including in-depth screening of the macroeconomic, regulatory and political factors. This is supplemented by on-the-ground resources, with managers often conducting regular visits to meet with companies, competitors, suppliers and local officials.

There are currently ten trusts in the AIC Global Emerging Markets category. The majority focus on emerging markets with limited exposure to frontier markets, although three specifically include frontier markets in their investment objectives. The scope varies by trust, with some trusts investing in a more concentrated portfolio of companies while others take a broader approach.

Case study: BlackRock Frontiers (BRFI)

Launched: 2010

Investment manager: BlackRock Fund Managers

Managers: Sam Vecht and Emily Fletcher

Dividend policy: Aims to pay a dividend semi-annually

Benchmark: MSCI Frontier + Emerging ex Selected Countries Index (net total return, USD)

BlackRock Frontiers (BRFI) is currently one of the few investment trusts listed on the London Stock Exchange that provides investors with dedicated exposure to frontier markets and smaller emerging markets. There is also no open-ended fund that invests in the same markets.

The trust was launched just over a decade ago in 2010 and is managed by Emily Fletcher and Sam Vecht, with a combined experience of more than 40 years.

BRFI invests in a bespoke investment universe of the MSCI Emerging Markets and MSCI Frontier Markets indices, minus the seven largest countries by market capitalisation (being Brazil, China, India, Korea, Mexico, South Africa and Taiwan).

The trust provides investors with a diversified portfolio that has a low correlation to developed markets, combined with superior growth potential.

What is the trust’s goal?

BRFI aims to achieve long-term capital growth by investing in companies that are listed in, or that derive the bulk of their revenue from, less developed countries.

What kind of stocks do the managers invest in?

The managers invest in companies that have strong balance sheets and can translate top-line revenue growth into strong free cash flow.

Are investments driven by a particular style?

BRFI’s investments aim to take advantage of the growth potential that frontier markets offer. Nonetheless, their focus on cash-generative businesses also means they have a long track record of paying a dividend.

Frontier markets tend to be more subject to macro-risk than developed markets. As a result, the managers combine both top-down and bottom-up analysis in their decision making.

With regard to the former, the managers use a proprietary macro dashboard to monitor factors like liquidity, currency and political risk. If these factors pose significant risks, the managers will usually not invest, regardless of how attractive a company’s fundamentals might be.

How many companies does the trust normally hold?

The trust typically has exposure to 35-65 holdings diversified across regions and sectors, aided by the lack of correlation within frontier markets.

What is the trust’s dividend policy?

The trust does not have a specific dividend target but pays a semi-annual dividend. The dividend yield was 4.5% (as at 19/08/2025).

What are the trust’s ongoing charges?

The trust’s ongoing charges are 1.4% (ex-performance fee).

Does the trust have a performance fee?

The trust has a performance fee equal to 10% of any NAV outperformance relative to the cumulative benchmark returns since inception. The performance fee payable in any year is capped at 2.5% of the gross assets of the company if there is an increase in the NAV per share, or 1% of the gross assets of the company if there is a decrease of the NAV per share, at the end of the relevant performance period.

How much attention do the managers pay to their benchmark, and to what extent are absolute returns important?

BRFI uses a bespoke benchmark index, which it deviates from markedly on both a sectoral and country allocation basis. Although the managers can (and do) use derivatives to take short positions in the market, this is not an absolute returns strategy. The maximum permissible exposure to short positions is 10% of net assets.

Does the trust use gearing? Is it structural or opportunity-led?

BRFI uses opportunity-led gearing, which is typically achieved by buying or selling contracts for difference (CFDs). The managers take both short and long positions in the market using derivatives.

See the latest research on BRFI here >

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by BlackRock Frontiers. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Leave a Reply

You must be logged in to post a comment.