Aug

2025

Kepler rates the best trading platforms for DIY investors

DIY Investor

4 August 2025

We round up the best trading platforms for UK investors…by Jo Groves

The rise of the DIY investor has transformed the trading landscape over the last decade. Once the preserve of wealth managers and stockbrokers, investing is now firmly in the hands of the masses, with over ten million DIY accounts opened in the UK since the pandemic.

This boom has fuelled a surge in platforms, with traditional providers facing stiff competition from app-based challengers. It’s good news for investors, with fees being cut across the board, but with nearly 100 platforms to choose from, the choice can feel overwhelming.

And that’s where we come in: we’ve reviewed and ranked the top platforms based on fees, investment choice and customer support to help you find the best provider for your needs.

You’ll also find the answers to your burning questions in our FAQs below, including how trading platforms work, what you can invest in and which fees to look out for.

Why fees matter…

It’s easy to overlook small differences in fees but they can really add up over time.

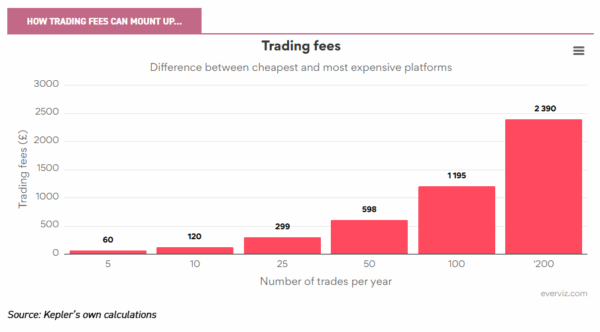

The chart below shows how the gap between the cheapest and most expensive platforms in our group can cost investors hundreds, or even thousands, of pounds a year in trading fees alone.

It’s a similar story for platform fees. If you invested £50,000 in funds growing at 10% a year, your portfolio would be worth around £336,000 after 20 years with a zero-platform fee provider. But pick a platform charging 0.45% a year and you’d end up with almost £30,000 less, purely due to fees eroding your returns over time.

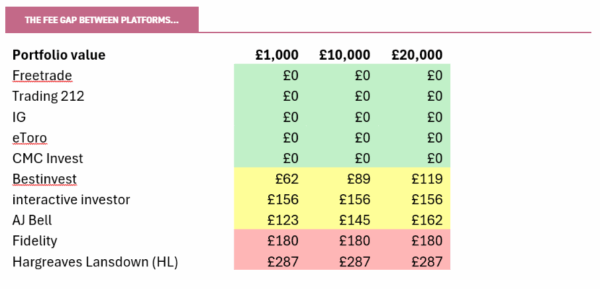

You’ll find full details of fees below, but the following table gives a quick snapshot of fees by provider, with green being the cheapest and red the most expensive:

The best trading platforms

The table below sets out our pick of the best trading platforms, with the methodology behind our rankings set out below (including the basis of our fee calculations).

Why we picked it

Freetrade is a UK fintech with over one million users. It was acquired by IG in early 2025 but will remain a standalone brand. It offers an investment account, ISA and SIPP but does not currently provide a Junior or Lifetime ISA.

Clients can access almost 6,000 UK, European and US shares, as well as 600 ETFs and investment trusts. Actively-managed funds are only available through the Plus plan. Freetrade also offers fractional US shares.

Fees

Freetrade charges no trading fees but platform fees vary by plan:

- Basic plan: no platform fee, lower interest on uninvested cash and 0.99% FX fee

- Standard plan: platform fee of £60 per year, includes an ISA, higher interest on uninvested cash and 0.59% FX fee

- Plus plan: platform fee of £120 per year, includes SIPP, highest interest on uninvested cash and 0.39% FX fee

Other key features

- Minimum investment: £1 (lump-sum and monthly)

- Interest paid on uninvested cash (subject to a cap)

- Customer support only available online

- Active investor community forum

- One of the lower Trustpilot ratings of 4.1

Freetrade takes the accolade of our best trading platform, thanks to its commission-free trading, wide range of shares and simple app. While it perhaps lacks the depth of research and range of accounts offered by the mainstream providers, it’s a solid choice for cost-conscious investors.

Why we picked it

interactive investor (ii) has over 450,000 clients and is owned by fund manager abrdn (though it continues to offer third-party funds). It offers a trading account, SIPP and Junior ISA but not a Lifetime ISA.

Clients have access to over 40,000 investment options, including 17 international markets across the UK, Europe, North America and Asia Pacific, as well as more than 3,000 funds and 1,000 ETFs and a selection of investment trusts. It does not offer fractional shares but does offer multi-currency accounts, which are a good tool to use given the high foreign exchange fee.

Fees

ii charges one of the lowest trading fees amongst the mainstream platforms:

- £3.99 (UK & US shares and funds)

- £9.99 (other international shares)

- Foreign exchange fee: 1.5% (under £25,000)

ii is one of the few platforms with a flat (rather than percentage-based) platform fee, making it a cost-effective option for investors with higher-value portfolios:

- Investor Essentials plan (for portfolios up to £50,000): £4.99 per month (includes a trading account and ISA)

- Investor plan (for £50,000-plus portfolios): £11.99 per month (as above, plus a Junior ISA) with one free monthly trade

- Super Investor plan: £19.99 per month (as above) with four free monthly trades

Other key features

- Minimum investment: £1 (lump-sum) and £25 (monthly)

- One of the lower interest rates on uninvested cash

- Good customer support by phone and online

- Second-highest Trustpilot rating of 4.7

Overall, interactive investor may appeal to high-value investors seeking a flat-fee structure or frequent traders looking for a reasonably priced mainstream platform with the widest range of options.

Why we picked it

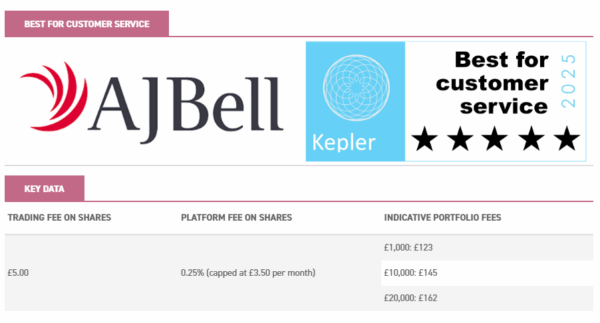

AJ Bell is a FTSE 250 company with over 590,000 clients. It offers the full suite of a dealing account, SIPP, Junior ISA and Lifetime ISA.

It provides access to over 16,000 UK and international shares across 24 markets, 4,000 ETFs, 4,600 funds and 370 investment trusts, the second-highest amongst our group. It does not offer fractional shares.

Fees

AJ Bell charges a mid-range trading fee on shares:

- £5.00 (0-9 trades in previous month)

- £3.50 (10+ trades in previous month)

- Funds: £1.50

- Foreign exchange fee: 0.75% (under £10,000)

AJ Bell charges a platform fee on both shares and funds:

- Shares, ETFs, and investment trusts: 0.25% (capped at £3.50 per month)

- Funds: 0.25% on first £250,000, tapering to 0.25% and 0.10% thereafter

Other key features

- Minimum investment: £1 (lump-sum) and £25 (monthly)

- One of the lowest interest rates on uninvested cash

- Good customer support by phone and online

- Highest Trustpilot rating of 4.9

Dodl, AJ Bell’s simplified app, may also appeal to investors happy to choose from a narrower investment range in exchange for lower fees. It charges a platform fee of 0.15% (with a £1 monthly minimum) and no trading fees. There’s a choice of around 80 UK and US shares plus 30-odd funds with a minimum monthly investment of £25.

AJ Bell stands out as an excellent all-rounder, combining reasonable fees, a broad choice of investments and high customer satisfaction.

Why we picked it

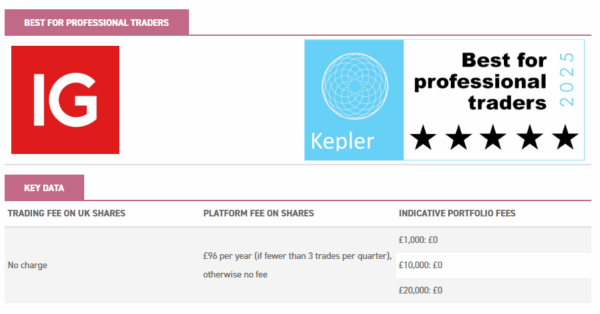

IG is a FTSE 250 company with over 300,000 global active clients. It offers an investment account, ISA and SIPP (via a partnership) but does not currently provide a Junior or Lifetime ISA.

Clients can access over 11,000 UK, US, European, Asian and Australian shares and investment trusts and 2,000 ETFs, but not actively-managed funds or fractional shares.

IG offers a range of leveraged products for experienced traders, as well as the option to trade on third-party platforms such as MetaTrader4, ProRealTime and API trading options. IG’s main trading platform is comprehensive but may feel overwhelming for beginners.

Fees

IG charges no trading fee on US, UK, European and Australian shares, together with a foreign exchange fee of 0.7%.

A platform fee is only charged for less frequent traders, as follows:

- £24 per quarter (£96 per year) if fewer than 3 trades per quarter

- Waived if you hold £15,000 in an IG Smart Portfolio account

Other key features

- Minimum investment: £1 (lump-sum)

- Monthly investing is not available

- One of the highest interest rates on uninvested cash

- Customer support only available online

- One of the lowest Trustpilot ratings of 3.9

IG is likely to most appeal to experienced investors looking for low-cost trading, advanced trading tools and a broad range of global equities. Its competitive fees may attract a wider audience but beginners may find the app more challenging to navigate.

Why we picked it

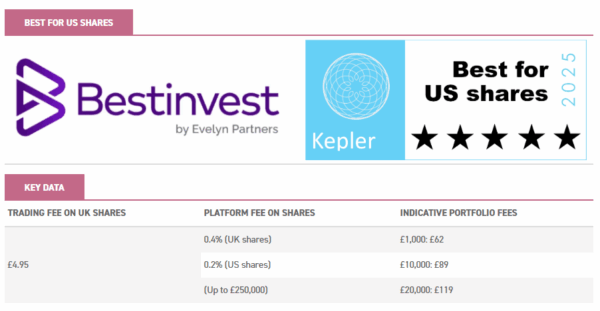

Bestinvest is owned by wealth manager Evelyn Partners and has over 50,000 clients. It also offers an investment account, SIPP and Junior ISA, but not a Lifetime ISA.

Clients can access over 1,200 UK and US shares, 1,700 funds, 500 ETFs and 230 investment trusts. It does not offer fractional shares.

Fees

Bestinvest does not charge a trading fee on funds and charges a competitive fee on shares:

- UK shares: £4.95

- US shares: no charge

- Foreign exchange fee: 0.95%

The platform fee is more competitive for investors wanting to hold US shares:

- UK shares & funds: 0.4% (on the first £250,000), tapering to 0% for higher amounts

- US shares: 0.2% (as above)

Other key features

- Minimum investment: £50 (lump-sum and monthly)

- One of the higher interest rates on uninvested cash

- Good customer support by phone and online

- Free one-on-one financial coaching

- Mid-range Trustpilot rating of 4.4

Overall, Bestinvest is a decent all-rounder and is likely to appeal more to traders in US shares due to the free trading fee and lower platform fees.

Why we picked it

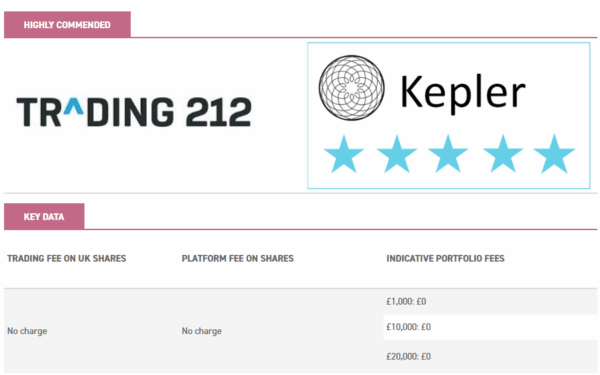

Trading 212 is a UK fintech with over four million lifetime funded accounts globally. It’s FCA-authorised, profit-making, and privately-owned. It offers an investment account and Individual Savings Account (ISA) but does not currently provide a Self-Invested Personal Pension (SIPP), Junior ISA or Lifetime ISA.

Clients can access over 11,000 UK, European and US shares and 2,000 ETFs, though actively-managed funds are not available. It also offers ready-made ‘model pies’ made up of ETFs, as well as fractional shares.

Fees

Trading 212 charges no platform or trading fees and the lowest foreign exchange fee of 0.15% among our group. There are also no inactivity fees.

Other key features

- Minimum investment: £1 (lump-sum and monthly)

- One of the highest interest rates on uninvested cash

- Customer support only available online

- One of the highest Trustpilot ratings of 4.6

Trading 212 takes the accolade of our best trading platform thanks to its unbeatable fees, market-leading interest on uninvested cash and one of the broadest ranges of investments. While it lacks the research tools and customer support of the mainstream providers, it’s hard to beat for investors seeking a low-cost, no-frills option.

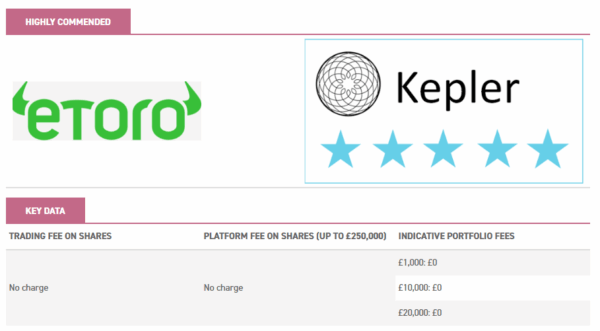

Why we picked it

eToro is a global fintech platform with over 35 million users. It offers an investment account and ISA (via Moneyfarm) but no SIPP, Lifetime ISA or Junior ISA.

Clients can access over 6,000 stocks in the UK, US, Europe and Asia Pacific and 700 ETFs, as well as commodities and currencies. It also offers fractional shares.

eToro is best known for its copy trading features, which allow clients to replicate the trades of other investors in real time, as well as review their performance and portfolio allocations.

Fees

eToro charges no trading or platform fees, together with a foreign exchange fee of 0.75%.

Clients can hold funds in USD or GBP accounts but currency conversion and other fees may be charged for transfers, deposits and withdrawals in different currencies (depending on the payment methods and level of membership).

Clients should also watch out for the $10/month inactivity fee charged to accounts with no logins in the previous 12 months.

Other key features

- Minimum investment: $50 (lump-sum) or $25 (monthly)

- One of the highest interest rates on uninvested cash

- Customer support only available online

- Mid-table Trustpilot rating of 4.2

Overall, eToro may suit investors wanting low-cost, commission-free trading paired with social features and fractional shares, though it’s worth keeping an eye on inactivity fees and foreign exchange fees when swapping between currencies.

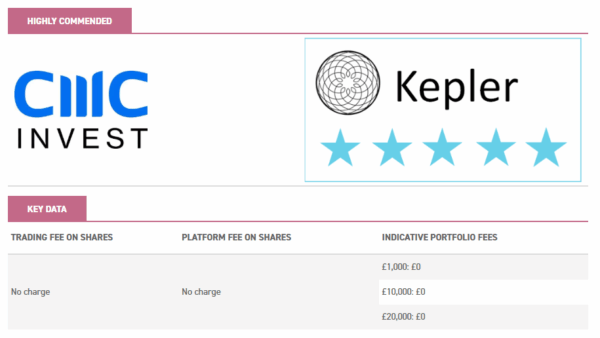

Why we picked it

CMC Invest is the consumer arm of FTSE 250 CMC Markets. It offers an investment account, ISA and SIPP but no Junior or Lifetime ISA.

CMC provides access to over 4,500 UK and US shares and 400 ETFs and investment trusts, with additional investments (including funds and AIM shares) available on paid-for plans. It does not offer fractional shares.

Fees

CMC charges no trading fees, a foreign exchange fee of 0.50% and the following platform fees:

- Core plan: no charge (3,000+ US shares, UK large-caps, ETFs and investment trusts)

- Plus plan: £10 per month (also includes UK small and mid-cap shares and funds, plus an ISA)

- Premium plan: £25 per month (as above, plus a SIPP and USD and EUR wallet)

Other key features

- Minimum investment: £1 (lump-sum)

- No monthly investing

- One of the lowest interest rates on uninvested cash

- Customer support by phone or online

- One of the lower Trustpilot ratings of 3.9

CMC Invest may appeal to investors looking for low-cost, commission-free trading with a decent range of investments. While its free plan covers the basics, the paid tiers offer broader investment access and additional features such as a SIPP and multi-currency accounts.

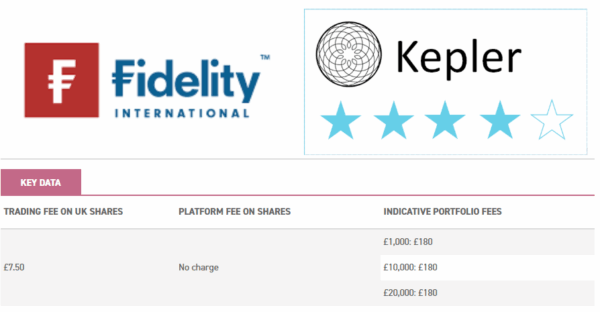

Why we picked it

Fidelity has over 1.6 million customers in the UK and, unlike some of its fund management peers, offers a wide range of third-party funds alongside its own. It provides an investment account, SIPP and Junior ISA but not a Lifetime ISA.

Clients can access over 2,400 UK, US and European shares, 2,900 funds, 400 ETFs and 170 investment trusts; one of the smaller ranges among the platforms in this group. It does not offer fractional shares.

Fees

Fidelity does not charge a trading fee on funds, but it is one of the more expensive for shares:

- £7.50 per trade

- Foreign exchange fee: 0.75% (under £10,000)

Fidelity is unusual in charging a non-tiered platform fee, meaning that you pay one fee based on the total value of your portfolio (across all accounts), rather than different fees on different portions. This may appeal to investors with higher-value fund portfolios that can benefit from the lower platform fee that kicks in at £250,000.

- Shares, ETFs and investment trusts: no charge

- Funds: 0.35% on first £250,000 (minimum of £90 a year for sub-£25,000 portfolios with no regular savings plan in place), tapering to 0.2% and 0% thereafter

Other key features

- Minimum investment: £1,000 (lump-sum) and £25 (monthly)

- Mid-table interest rate on uninvested cash

- Decent customer support by phone and online

- Mid-range Trustpilot rating of 4.4

Overall, Fidelity may be a good option for investors with higher-value portfolios, which can benefit from reduced platform fees, although the share trading fee and more limited set of investments may deter frequent traders.

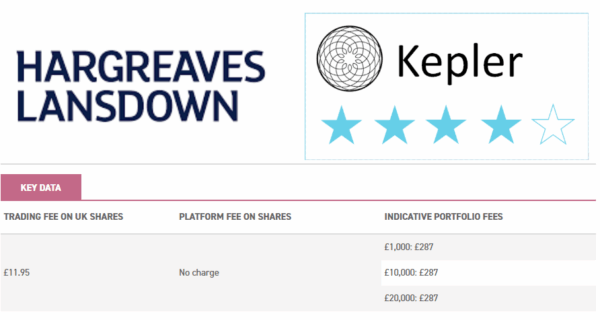

Methodology

To come up with our list of best trading platforms, we applied three main criteria, being whether providers:

- charged competitive trading and platform fees

- offered customers a broad range of third-party investments

- had a good rating on consumer review site Trustpilot

We also considered other features such as our personal experience of the providers, the option to hold other accounts such as SIPPs and the level of customer support.

We calculated indicative fees on the following basis:

- Split of portfolio: 50:50 between UK and US shares

- Trading fees: 24 trades per year (split equally between UK and US shares and across the year as a whole)

- Portfolio values: £1,000, £10,000 and £20,000.

Frequently asked questions

What is a trading platform?

A trading platform allows investors to buy and sell shares, funds, investment trusts and exchange-traded funds (ETFs) directly rather than through a financial adviser or traditional stockbroker. Often called a DIY platform or online brokerage account, it’s essentially a way to hold and manage your investments in one place.

You can place trades online or via an app with real-time access to your portfolio. Fees are usually lower than using an adviser or broker, and many platforms offer educational tools and curated fund shortlists to help you build your portfolio.

What fees should you watch out for?

It’s important to understand the fees involved as these can significantly impact your returns over time. There are three main types of fees:

- Platform fee: This is a fee for holding investments on the provider’s platform, usually a percentage of your total portfolio value (typically 0.25%-0.45% per year). Platform fees may be capped at a maximum amount per year and can vary according to whether you hold share-based investments (company shares, ETFs and investment trusts) or funds. Alternatively, some providers offer a flat or no fee. Platform fees are usually tiered, meaning that you’ll pay a lower platform fee on the portion of your portfolio over certain thresholds, for example, 0.25% up to £250,000, then 0.1% on the portion between £250,000 to £500,000 and no fee on the portion above £500,000.

- Trading fee: You’ll typically pay a trading fee of £4 to £12 for buying shares (including ETFs and investment trusts), although some platforms offer commission-free trading. Trading fees for funds are generally lower, or often zero, and frequent traders often pay a lower fee, usually based on the number of trades in the previous month or quarter.

- Fund management fee: As mentioned below, you’ll pay an annual management fee for investing in funds, which is typically between 0.1% and 1%.

What type of trading account should you consider?

While we’ve focused on general trading accounts, it’s worth looking at tax-efficient wrappers like ISAs and SIPPs. These allow you to invest without paying income tax on dividends or capital gains tax on profits.

Some (though not all) of the platforms listed also offer ISAs and SIPPs alongside general trading accounts. We’ve also produced guides on the best ISA providers, best Junior ISA providers and best SIPP providers.

How do you open a trading account?

Opening a trading account is usually straightforward and can often be done online in around ten minutes. You’ll need to provide some basic details, including your bank account and National Insurance number. Most checks are carried out electronically, though you may be asked to upload documents for verification purposes.

Once you’ve deposited funds into your account, you’re ready to start trading. You can trade shares live when stock markets are open. For the London Stock Exchange, this is 8:00am to 4:30pm UK time. For US markets such as the Nasdaq and NYSE, normal trading hours are 9:30am to 4:00pm Eastern Time, which is typically 2:30pm to 9:00pm UK time (depending on daylight saving).

What can you invest in?

A trading platform gives you access to a wide range of investments to suit different goals and risk levels. Most providers offer UK and US shares, with some also covering European, Australian or Asian markets.

Another option is funds which pool your money with other investors to invest in a portfolio of assets. There are two main types of funds:

- Actively-managed funds: These are professionally managed by fund managers who pick a basket of investments such as equities, bonds or commodities. These typically charge a higher annual management fee of 0.5% to 1.0%.

- Passively-managed funds: Also known as index, tracker or ETFs, these track an index such as the FTSE 100 or S&P 500, although there are more specialist options tracking commodities and property indices. Fees are usually lower, at around 0.1% to 0.5%.

If you’d prefer a more hands-off approach, platforms also offer:

- Ready-made portfolios tailored by risk level and managed on your behalf.

- Robo-advisers, which use an online questionnaire to build an automated portfolio based on your goals.

- Financial advisers offering personalised advice, though this is usually the most expensive route.

How much money do you need to open a trading account?

This depends on the platform, but many allow you to open an account with as little as £1 (or £25 a month for monthly investing). You’ll need to add further funds to the account depending on the cost of the investment you’re purchasing.

Can you buy US shares on a UK trading platform?

In short, yes. You’ll typically pay a trading fee and a foreign exchange fee to convert pounds to dollars. You’ll also need to complete a W-8BEN form (valid for three years) to benefit from a reduced US dividend withholding tax rate of 15% instead of 30%.

Foreign exchange (FX) fees vary widely across the platforms we reviewed, ranging from 0.15% to 1.50%. If you paid a 1.0% FX fee on a £1,000 purchase of US shares, you’d be charged £10 to convert your money into dollars. Some platforms offer multi-currency accounts, which can reduce the need for repeated currency conversions when trading in overseas investments.

It’s also worth remembering that holding US shares exposes you to currency risk. If the pound strengthens against the dollar, your investment may fall in value when converted back to sterling, even if the share price rises in dollars.

Do you pay tax on profits made through a trading platform?

When you buy UK shares, you’ll usually pay Stamp Duty Reserve Tax (SDRT) at 0.5% of the transaction value. This doesn’t apply to overseas shares (though other taxes may apply).

If you sell shares for a higher price than you paid for them, you may have to pay capital gains tax on the profit. The current capital gains allowance is £3,000 (for the 2025-26 tax year), meaning that capital gains below this amount should be tax-free.

You may also pay income tax on dividends. The current dividend allowance is £500 in addition to your annual personal allowance of £12,570 (in the 2025-26 tax year).

No income or capital gains tax is payable on investments held in ISAs, SIPPs or Junior ISAs.

What are fractional shares?

Fractional shares allow you to buy part of a share, such as 0.5 or 0.25, rather than a whole share. You’ll receive a share of any dividends paid and benefit from any increase in the share price.

Not all platforms offer fractional trading, but it can be a handy option if you’re investing smaller sums. A case in point is Berkshire Hathaway’s Class A shares, which trade at hundreds of thousands of dollars each (and frankly, it would be cheaper to pick up a flat in London…).

Is your money safe on a trading platform?

When choosing a trading platform, you should check the FCA register to ensure that your platform is authorised. This means that you should have access to the Financial Ombudsman Service and the Financial Services Compensation Scheme (FSCS) if an issue arises.

The Financial Ombudsman Service will consider complaints against trading providers and may be able to resolve your complaint if the firm fails to deal with it properly.

The FSCS will consider claims if your trading provider goes out of business and owes you money; however, it relates only to certain investment products. If the product is covered, the FSCS can pay up to £85,000 per investor.

It’s worth checking the protection offered by your trading platform: some platforms are structured so that investments are held in ‘trust’ to protect them in the event of the firm running into financial difficulties.

It’s also important to remember that your investment can go down as well as up, and you may not get your money back. Investing in a diversified portfolio of shares via a fund, investment trust or ETF may help reduce your exposure to an individual company underperforming.

However, if you are unsure as to the right option for your circumstances, you should seek independent financial advice.

What is the best trading platform for beginners in the UK?

The best platform depends on your needs, but most beginners look for low fees, a user-friendly app, solid educational tools and access to UK and US stocks.

Some platforms offer virtual portfolios, which are an ideal way to build your investing skills without risking real money. Many providers also provide free guides and webinars, which are often available even if you’re not a customer.

It’s also worth considering the level of customer support. While zero-commission apps tend to offer online-only help, mainstream providers such as HL and AJ Bell also offer phone support, which can be helpful if you’re just starting out.

How does monthly investing work?

Monthly investing allows you to invest a fixed amount (usually a minimum of £25 per month) into shares, funds, or ETFs. Your money is automatically invested on a set date each month, helping you build your portfolio gradually without needing to time the market.

It’s a good way to benefit from pound-cost averaging, whereby you can buy more units when prices are low and fewer when they’re high. Some platforms offer discounted trading fees for monthly investing, making it a cost-effective option for long-term investors.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.