Jul

2025

Mid-year investment outlook: has the US become unexceptional?

DIY Investor

20 July 2025

We run the rule over the US-to-rest-of-world rotation in the latest mid-year outlooks…by Jo Groves

We may be only halfway through 2025 but markets have already served up a year’s worth of drama: the DOGE bromance is well and truly over, tariff turmoil rages on and there’s still no resolution in the Middle East.

All of which makes crystal ball gazing especially fraught (though someone taking one for the team and disabling Donald Trump’s CAPS LOCK!!! key might be a good start…).

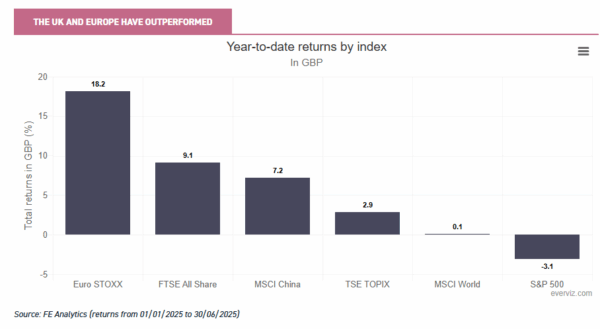

Let’s start with a whistlestop tour of the leaderboard at the halfway mark. And there’s been a clear reversal in fortunes, with the UK, Europe and China powering ahead while a weaker greenback has trimmed already modest US returns.

Beneath the headline numbers, fading confidence in both the US dollar and exceptionalism is ushering in a new macro regime. In short, this isn’t a rising tide lifting all boats – regional allocation matters more than ever.

So, without further ado, what are the key takeaways from the latest round of investment outlooks from BlackRock, Invesco, JP Morgan and Fidelity?

What’s the big picture?

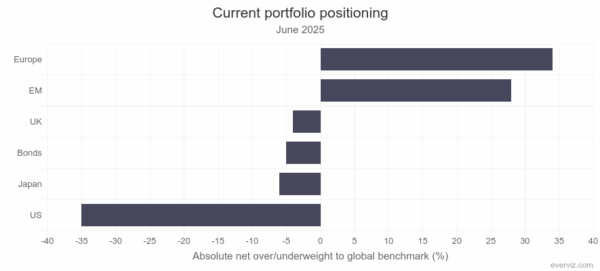

Bank of America’s latest fund manager survey reveals a significant shift in portfolio allocation: there’s now a net 35% underweight to US equities (relative to the global benchmark), the lowest in nearly two years and the biggest swing on record.

So where’s that money going? Into European and emerging markets, with most managers expecting international markets to lead over the next five years. Bonds and UK and Japanese equities remain in negative territory for now but sentiment is improving.

In short, managers are pivoting away from US exceptionalism in search of better prospects.

Where are the most compelling opportunities?

1. Clouds gather for US equities

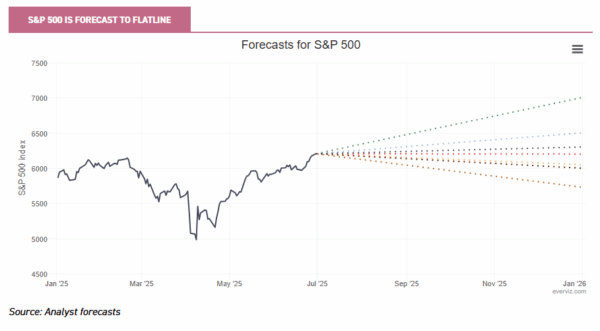

Starting with the S&P 500, strategists were bullish heading into 2025, predicting a 12% gain to 6,600. Wall Street’s bellwether index had risen 6% to 6,200 by mid-year but sentiment has undoubtedly cooled.

Forecasts are now split between the bulls and bears, with the consensus position expecting little to no progression in the second half of the year.

What’s weighing on US sentiment? Top of the list is the ballooning fiscal deficit, inflated by Trump’s so-called Big Beautiful Bill.

Invesco notes: “An already high fiscal deficit is poised to widen further with tax cuts, potential recession risks and fears of slower trend growth.”

BlackRock also highlights macro headwinds in the US, citing persistent inflation pressures from geopolitical fragmentation, slowing immigration and the delayed impact of tariffs.

The US recently suffered its first quarterly GDP contraction in three years and the outlook for the rest of the year is subdued alongside a softening in business and consumer confidence.

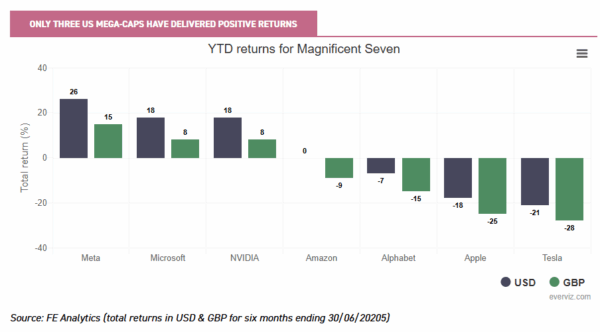

While the Magnificent Seven have propelled markets to record highs, 2025 has certainly tested their invincibility. Only the Tenacious Three of Meta, Microsoft and NVIDIA are in positive territory this year, largely on the back of their AI-centric strategies.

At the other end of the spectrum, Alphabet, Apple and Tesla have endured sharp declines, further exacerbated for overseas investors by a weakening dollar (more of which later).

Concerns persist over valuations, though earnings have held up so far this year. BlackRock and Fidelity both flag the narrowing US growth advantage versus the rest of the world, with the advent of Chinese AI models casting doubt on whether the US mega-caps still warrant their current premiums.

JP Morgan adds: “Consensus earnings expectations are still more optimistic than the macro outlook implies… valuations have little room to absorb any earnings disappointment.”

That said, mega forces such as AI should continue to underpin returns, with Fidelity’s Tom Stevenson calling for calm: “US exceptionalism was built over decades; it will not disappear in a matter of months.”

2. Will UK equities score a home run?

As US enthusiasm fades, UK equities are finally staging a comeback. All the major UK indices (from the FTSE 100 to Small Cap) have outpaced the S&P 500 in local currency terms this year. Defensive sectors such as tobacco, telecoms and insurance are back in vogue and defence stocks are benefiting from higher government spending.

Fidelity points to “cheap” valuations with both the international FTSE 100 and the more domestic FTSE 250 trading at a “massive discount” to the US, offering “better value” Europe and Japan.

Tailwinds include improved US and EU trade relations and a post-pandemic savings cushion. Fidelity sees the UK “as a cheaper, back-door way to invest in the global economy… with a healthy dividend yield of nearly 4% to reward you while you wait for a re-rating.”

Risks remain, including upcoming tax hikes in the Autumn Budget and a potential pause in monetary easing if inflation ticks up. But, as Fidelity cautions, it’s dangerous to conflate economic and equity performance, not least as FTSE 100 earnings are arguably more exposed to the US economy than the UK.

3. Has Europe turned the page?

European equities are having a rare moment, pulling in $16 billion of inflows so far this year. Fidelity observes that “Europe is benefiting from not being America”, offering a more stable version of the US at a “much more attractive valuation.”

JP Morgan notes: “Europe is often at its best when faced with a common adversary or crisis” and the prospect of a second Trump presidency seems to have lit a fire under lawmakers.”

Fidelity adds: “Trump 2.0 has galvanised Europe like nothing else in the last troubled decade. Germany’s parliament has approved incoming Chancellor Merz’s plans to reform the country’s constitutional debt brake…paving the way for a €500bn investment fund worth nearly 12% of German GDP over ten years.”

Risks include US tariffs and lofty valuations in defence and infrastructure stocks which are predicated on a long growth runway. But investors may take comfort that Europe boasts the highest overweight in the latest Bank of America survey.

As Fidelity’s Tom Stevenson puts it: “Investors may fear they have missed the boat in Europe. They needn’t.”

4. Asia & emerging markets: fragile recovery or breakout in disguise?

Emerging markets haven’t fully benefitted from the shift out of US assets, largely due to tariff concerns.

Some of this is understandable but it’s important not to overlook the heterogeneity of such a vast and diverse universe. The US accounts for just 3% of MSCI China revenues, compared to 40% in Taiwan, according to Fidelity.

The MSCI Emerging Markets Index has quietly chalked up an 11% return in the first half of the year, with Fidelity noting that “the impressive rise in some of those markets this year could have legs.”

China, once viewed as near-uninvestable, is also back on investors’ radars, buoyed by

an improving earnings outlook, looser domestic policy and DeepSeek’s emergence as a viable AI challenger to the US. Valuations remain attractive with tariff risks arguably priced in (unlike in some other markets). In addition, the introduction of tariffs may prove the catalyst for a shift to consumption-led growth.

India, despite its growth poster-child status, has seen downward earnings revisions stir valuation concerns, but BlackRock highlights its demographic dividend, with infrastructure its preferred exposure to ride the mega-trends.

Meanwhile, reflation remains the key story in Japan. Above-inflation wage growth is boosting consumption, and after years of deflation, price growth is welcome. But the trade-heavy economy faces external risks, and as JP Morgan notes, a stronger yen could weigh on the overseas earnings of Japan’s global leaders.

Overall, a weaker US dollar should provide a tailwind for emerging markets but JP Morgan points to the biggest draw being the opportunity to tap into “breakneck pace” of technology innovation across Asia.

5. Bonds: a bad weather hedge, not a comfort blanket

Fixed income investors are currently having to walk a tightrope between lingering inflation and slowing growth. With US recession fears flickering, JP Morgan advises holding bonds “for bad weather not all weather” though recent correlations haven’t always been helpful.

Shorter-dated government bonds are highly sensitive to interest rate expectations and continue to price in some monetary easing if US tariffs drag on economic growth. Longer-dated bonds march to a different beat, however, with long-term inflation expectations and issuer creditworthiness driving yields.

As a result, BlackRock favours short-term Treasuries, citing the inflationary potential of US tariffs, and remains underweight long duration due to fiscal deficits and inflation pressures. JPMorgan, however, believes leaning into duration could make sense if 10-year Treasury yields climb back toward 5%.

Consensus is more positive on global ex-US bonds: Invesco favours longer duration bonds, particularly in Europe as the ECB cuts rates, while JPMorgan argues that “gilts are arguably best positioned” given the UK’s fiscal constraints.

Corporate bonds still offer decent headline yields, but tight spreads leave little margin for error if the economy falters.

Why investors shouldn’t ignore FX

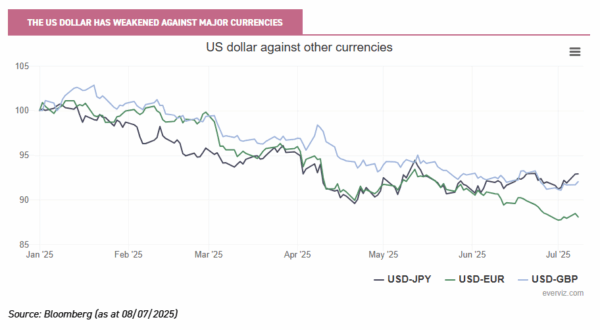

Currency swings have played as much of a role as underlying returns at times this year, with the weakening dollar turning a 6% gain on the S&P 500 into a 3% loss for UK investors.

JP Morgan urges more attention to currency exposure. Even after this year’s correction, it believes the US dollar remains “a very expensive currency” at 13% and 10% above its fair value calculations versus the euro and pound. It concludes that “the key question for investors is how orderly a dollar decline could be”.

And it’s not just about direct FX exposure for investors: currency shifts affect corporate earnings too, with a weaker dollar boosting overseas profits for US firms whereas a stronger yen or euro can weigh on exporters’ margins. For emerging markets, a soft dollar also gives breathing room for rate cuts, with real EM rates at 20-year highs.

BlackRock notes “it would take a lot, and some time, to change the dollar’s role as the global system backbone.” But JPMorgan warns, “Safe haven status no longer seems solid,” with the dollar’s correlation to equities rising sharply.

Bringing it all together

Fidelity suggests that investors “will be forgiven for looking at all of this and thinking as much about preserving their capital as growing it. Now feels like a good time not to be taking big bets on an unpredictable future.”

Although slowing growth and sticky inflation continue to test the traditional equity- bond correlation, bonds can still play a key role in hedging against recession risk.

Core real assets, such as infrastructure, offer long-term inflation protection while tapping into global mega-trends. And, while gold may be at record highs, central bank demand should be supportive as countries reduce their reliance on the dollar.

Liquid alternatives, such as hedge fund strategies with low correlations to bonds and equities, can also cushion portfolios and actively capitalise on volatility.

The last word on the topic goes to Fidelity: “Nothing goes on for ever. The bull market is mature. And the best time to fix the roof is when the sun is still shining. The ongoing rotation out of US markets points to a change in market leadership.

“Sticking with past winners may not be a smart strategy in a changing world. As ever, the best protection against an unpredictable future is to put your eggs in a wide variety of baskets.”

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.