Sep

2025

Monthly markets review – August 2025

DIY Investor

7 September 2025

A look back at markets in August when weak US jobs data raised the chances of an interest rate cut from the Federal Reserve.

The month in summary:

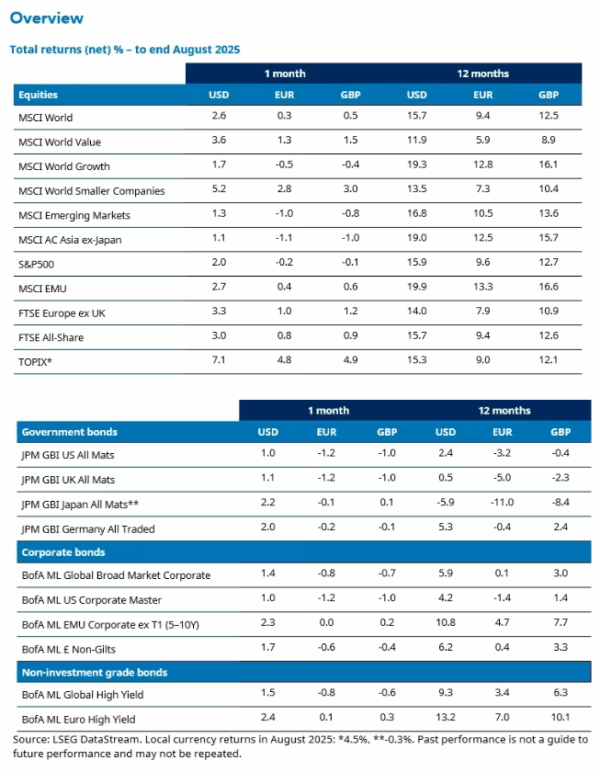

Strong corporate earnings, moderating inflation and the promise of lower interest rates enabled global equities to post positive returns in August. In fixed income, investment-grade credit posted solid gains, propelled by the number of companies whose earnings beat analyst estimates.

Please note any past performance mentioned is not a guide to future performance and may not be repeated. The sectors, securities, regions, and countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

Global equities

Global developed market equities posted a 2.6% gain in August, with particularly strong performance in Japan. Emerging market equities posted a lower, but still positive, return for the month, supported by gains in Latin America and China.

US

US shares, as measured by the S&P 500 Index, realised gains even amid concerns about a weaker-than-expected labour report, tariffs and persistent inflation. The July nonfarm payrolls report showed a steep decline in job creation, while also revising downward previous months’ figures. While a US appeals court declared the Trump Administration’s reciprocal tariffs illegal, it delayed enforcing its ruling until 14 October to give the Administration time to appeal to the US Supreme Court.

Markets were buoyed by the dovish tone Federal Reserve (Fed) Chair Jerome Powell took in a speech delivered at the Jackson Hole Economic Symposium. Powell noted the weakening labour market could justify a change in the Fed’s policy stance, and that increased the market’s expectations at the Fed will announce a rate cut at its mid-September meeting.

Information technology (IT) underperformed the broad market for the month. While the IT sector has had an exceptional year, some of that momentum might have been at least temporarily short-circuited by a report from the Massachusetts Institute of Technology that found 95% of corporate generative AI pilot projects failed to deliver a measurable financial return (although it noted the failure often resulted from poor execution rather than the technology itself). Materials was the strongest-performing sector for the month, as it benefited from progress toward trade agreements and expanding manufacturing activity. Health care also had a standout month, boosted by investors responding to attractive valuations and some favourable company-specific news.

A revised report revealed even stronger growth for the US economy in the second quarter, as the latest numbers showed a 3.3% annualised increase in GDP, up from the 3% originally reported. The personal consumption expenditures (PCE) price index showed that core inflation ran at a 2.9% annual rate in July. Even with that level of inflation, however, the Fed appears to see enough weakness in other economic indicators to warrant a rate cut in September.

Eurozone shares made a small gain in euro terms. Top performing sectors included energy and consumer discretionary. Within consumer discretionary, automotive stocks benefited from some relief that a tariff agreement with the US was reached in late July. The industrials and information technology sectors were among the main decliners. Among industrials, defence-related stocks declined amid some progress in security talks towards ending the war in Ukraine. Information technology stocks suffered from global weakness in the sector.

The HCOB flash eurozone purchasing managers’ index (PMI) rose to 51.1 in August, up from 50.9 in July. This indicates a pick-up in business activity and new orders returned to positive growth. The PMI is based on a survey of companies in the manufacturing and service sectors. A reading above 50 indicates expansion.

French shares fell late in the month on concerns the government will collapse. French Prime Minister François Bayrou called a confidence vote for 8 September after his plans to tackle the country’s widening deficit faced strong opposition in parliament.

UK

In the UK, the FTSE All-Share delivered a positive return in August. The best performing sectors were telecommunications, basic materials and energy. Technology suffered the sharpest declines amid some weakness in the sector globally. The large cap FTSE 100 outperformed the midcap FTSE 250 index.

The Bank of England cut interest rates by 25 basis points to 4.0%. However, the Monetary Policy Committee was split with four members voting for no change. Data from the Office for National Statistics showed inflation rose more than expected to 3.8% in July, casting further doubt on the likelihood of further imminent cuts.

Japan

The Japanese equity market extended its multi-month rally, with the TOPIX Total Return rising 4.5% and the Nikkei 225 up 4.0%. Early in the month, upside was capped by uncertainty around US policy and a cut to profit guidance cut at semiconductor tools maker Tokyo Electron. However, sentiment improved as softer US payrolls and Fed Chair Powell’s Jackson Hole remarks reinforced US rate-cut expectations.

Domestically, June-quarter corporate results were broadly resilient, and consensus estimates improved. Japanese Q2 GDP returned to growth and July inflation data (CPI) confirmed a continuing shift toward moderate inflation. Together, these factors supported market strength, while AI-linked data-centre demand added momentum to related Japanese companies.

Emerging markets

Emerging market (EM) equities delivered a positive return in August, helped by a softer US dollar; however, the EM index lagged the MSCI World.

The Latin American markets of Colombia, Chile, Brazil and Peru were the top performers in the month. The Brazilian market appeared to shrug off news that exports to the US will face 50% tariffs, instead it was supported by local currency strength and ongoing improvements in inflation data, which should pave the way for monetary policy easing. South Africa also posted a strong performance in the month, helped by local currency appreciation and stronger precious metals prices.

China gained, outperforming the EM index, as US-China trade talks resulted in another 90-day pause on tariffs. A continued focus on the anti-involution policy was also beneficial for the market. Taiwan delivered negative returns in US dollar terms with the local currency depreciating over the month. Some of the Middle Eastern markets, including Saudi Arabia, Kuwait and UAE declined against a backdrop of weaker energy prices. Meanwhile, the Korean market was lower in US dollar terms on the back of investor concerns around the potential impact of an increase in the corporate tax rate. Rising US trade tariffs, which have increased to 50%, and foreign equity outflows weighed on India’s market.

Asia ex Japan

The MSCI Asia ex Japan index made gains. Singapore was the strongest market in the index, followed by China, Malaysia and Hong Kong. India, Taiwan and Korea were laggards.

Singapore’s gains were driven by some strong corporate earnings. Chinese stocks continued to benefit from the government’s “anti-involution” campaign which aims to curb intense price competition and reduce overcapacity in certain industries. However, economic data remained lacklustre with an annual inflation rate of inflation 0% year-on-year in July.

Indian shares fell as the US raised the tariff rate to 50% (from 25%) in retaliation for India buying oil from Russia. The technology-heavy markets of Taiwan and Korea also underperformed in what was generally a weaker month for tech stocks. Worries over rising corporate taxes also weighed on Korean shares.

Global bonds

Global bond markets generated widely varying returns during August, buffeted by economic data and political developments.

US Treasury yields fell sharply at the start of August (reminder: yields move inversely to prices). This came as official figures showed a decline in new jobs created during July, with downward revisions for prior months. This negative economic development—which prompted the US President to immediately fire the head of the office responsible for the numbers—led markets to consider much more seriously the prospect of a near-term interest rate cut from the Fed.

Against a backdrop of increasing political pressure from the Trump Administration, comments from Fed principals later in the month—including Chair Jerome Powell in his speech at the Jackson Hole conference—appeared to move towards the idea of earlier cuts. They highlighted an increased focus on weakness on the labour market side of its dual mandate, rather than on inflation: the CPI report in mid-August duly came in lower than expected, defying widespread expectations for a tariff-driven rise.

While the shorter-dated end of the US Treasury market performed well in response, bonds with longer maturities continued to be plagued by concerns around the fiscal spending levels implied by last month’s budget bill, as well as worries about the Fed’s independence being compromised.

European government bond yields rose steadily through August (meaning prices fell). Survey data indicated a continued recovery in manufacturing and other cyclical sectors. With inflation broadly stable, the European Central Bank’s view seems to be that the current interest rate policy is accommodative enough and that further cuts from here are not necessary. German fiscal expansion in coming years contributes another negative factor for European government bonds; a looming political showdown over fiscal policy in France also provides reason for concern.

Gilt yields rose too. The Bank of England cut rates to 4% but the voting in favour of the move was less clear-cut than observers expected, indicated that the Bank is likely to continue its gradual approach and that further cuts are not imminent. Inflation figures supported this stance by coming in slightly higher than expected, and positive signs of improving activity in the economy suggested that growth may be less stagnant than previously thought.

Japanese government bond yields also continued to sell off significantly. Inflation is now well above the Bank of Japan’s ‘neutral’ level of 2%, with expectations continuing to rise (as consumers extrapolate their recent experience of higher rice prices in particular). Wage growth has reached 2% for the first time since the early 1990s—an era when policy rates were higher, and labour more plentiful. The government’s weak position means it is under political pressure to increase public spending.

The performance of corporate bond markets was generally more robust during the month. A relatively benign corporate environment in the US (and lower concerns around tariff levels) meant that US corporates performed well, outperforming European and UK indices.

After appreciating against other major currencies in July, the US dollar resumed its 2025 slide in August as lower interest rates from the Fed began to look more likely. The Japanese yen also performed relatively poorly over the month as markets focused on the rising political pressure on Prime Minister Ishiba’s minority government to increase public spending. The euro strengthened against the dollar and the yen. Sterling strengthened against other major currencies, responding to signs of improving activity in the economy and a reduced likelihood of cuts in UK interest rates in the near term.

Commodities

In commodities, the S&P GSCI Index fell slightly in August. The energy component was weaker in the month while other components gained. Oil prices fell mid-month after the International Energy Agency lowered its forecast for demand in 2025, while the US Energy Information Administration reported a rise in crude oil stocks.

Among agricultural commodities, coffee prices surged amid poor weather in Brazil and worries over tariffs. Gold continued to draw in investors amid expectations of an imminent US interest rate cut and concerns over political pressure on the Fed.

Digital assets

August was an eventful month where Ethereum and a select group of ‘altcoins’ (digital currencies other than Bitcoin) continued to outperform following recent regulatory clarity. After a long period of Bitcoin dominance, the market is showing signs of a shift. Ethereum has already started to outperform, with other altcoins such as Solana catching up more recently.

Flows into Ethereum exchange-traded funds and the upcoming launch of altcoin-focused investment products are helping drive this momentum. This is being accompanied by stronger fundamentals as blockchain integration into traditional finance accelerates under a more constructive US regulatory regime.

Past Performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.Investment involves risk.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy.

Issued in the UK by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority

Alternative investments Commentary » Brokers Latest » Commentary » Equities Latest » Exchange traded products Latest » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.