Aug

2025

Next-Gen Retirement Investing: How Young American Savers Are Rewiring the Future of Pension and What It Means for the World

DIY Investor

6 August 2025

They’re swapping tradition for tech, crypto, and innovation – gunning for bigger rewards and rewriting the rules of retirement investing

A seismic shift is underway in American retirement planning. As the classic pension fades, a new generation of 401(k) investors is rewriting the rules – turbo-charging their retirement accounts with higher-octane investments and accepting more risk for a shot at bigger rewards.

Not only the U.S. is grappling with a stressed retirement system where people are trying to figure out how to secure their retirement. Many countries move towards self-managed retirement models and grapple with similar generational divides.

Younger Savers Are Chasing Innovation and Changing the Game

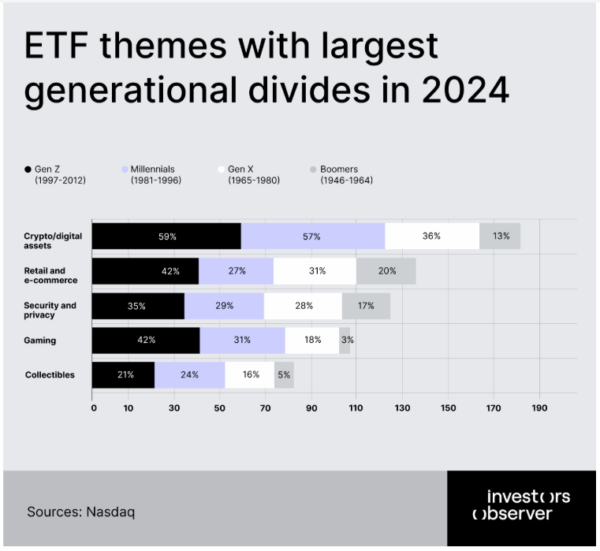

According to a new research report from Investors Observer, the gap between generations in how Americans invest for retirement is widening fast. Data through mid-2025 reveals that Gen Z and Millennials prefer cryptocurrency ETFs, fintech, AI, and gaming themes, while Gen X and Boomers double down on the slow-and-steady script – favoring funds focused on healthcare, real estate, and broad stock markets.

ETFs have now become the vehicle of choice for younger savers: 75% of Gen Z and 81% of Millennials hold ETFs in their retirement plans, compared to just 60% of Boomers. Appetite for digital asset ETFs has exploded – 59% of Gen Z and 57% of Millennials now hold them, versus only 13% of Boomers. Such dramatic differences suggest an underlying generational shift in risk tolerance, outlook, and expectations.

“This isn’t just chasing trends for the sake of it,” says Sam Bourgi, a finance analyst and researcher at Investors Observer. “Younger Americans are sprinting toward emerging sectors – they want to be part of what’s next, whether that’s AI, crypto, or clean energy. For them, the old playbook of set-it-and-forget-it doesn’t resonate anymore.”

When Innovation Pays and When It Doesn’t

The results show there’s substance to this strategy. YieldMax MSTR Option Income Strategy ETF, a favorite among younger investors, delivered a jaw-dropping 105.98% return over the past year. Tech-focused mutual funds like Fidelity Growth Strategies surged 22% year-over-year. International equity ETFs, such as Dimensional International Value, also posted standout returns of 21.44%.

Yet risk and reward go hand in hand. While Gen Z and Millennials have shifted fast into high-growth sectors tripling their preference for crypto in just a year, older generations, sticking with real estate and healthcare, saw more modest gains: just 4% for real estate index funds, although biotech ETFs provided a 17% lift. The trade-off is clear: less volatility, but likely less growth.

“It’s not just about choosing the flashiest sector,” Bourgi notes. “Fee-conscious young investors understand that the 1% in annual fees you don’t pay can stack up to a major advantage over 30 years. That focus on keeping costs ultra-low gives today’s ETF-heavy strategies global relevance.”

The Battle of Themes: Clean Energy, AI, Gaming, and More

Across all age groups, clean energy and energy transition funds are rising in popularity – yet younger Americans are leading this push, with nearly half of Millennials and 40% of Gen Z making these sectors priorities. Meanwhile, Boomers remain focused on real estate and healthcare – a pattern that speaks to the trade-offs between stability and growth.

Sectors like digital security, ESG (environmental, social, governance), and collectibles are attracting more interest from younger savers. “Even if you’re investing in your national pension system or personal accounts elsewhere, the lesson is to be alert to new categories, but not to lose sight of fundamentals,” advises Bourgi. “Diversifying across sectors and paying attention to fees can matter just as much as which fund you pick.”

No One-Size-Fits-All: The Big Picture

Gen Z and Millennials may be positioned for strong long-term growth, but they also face steeper risks and swings. Older investors, focused on steady performers and low volatility, could miss out on big wins in new sectors, especially if high mutual fund fees eat into gains.

Importantly, every generation faces trade-offs. Consistent contribution, careful risk awareness, and cost sensitivity are the most crucial ingredients for retirement success. Bourgi sums it up: “Long-term success requires more than picking themes. It’s important to have a strategy, watch costs, and stay flexible no matter how the world or the markets change.”

A Window Into the Global Future of Retirement

Even though these findings are rooted in American data, they’re relevant to people worldwide. As self-funded retirement savings grow, and as global investors weigh how to adapt to fast-moving innovation, America’s generational split offers a preview of the debates and choices all savers may soon face.

“Retirement investing is no longer set in stone and the future belongs to those willing to learn, adapt, and blend old wisdom with new ideas,” concludes Bourgi.

Leave a Reply

You must be logged in to post a comment.