Aug

2025

Schroder Japan Trust plc: Finding value in Japan’s AI supply chain

DIY Investor

30 August 2025

Japan’s AI role is growing – and Schroder Japan Trust is well-placed to benefit

The rise of artificial intelligence (AI) has become one of the most powerful themes in global equity markets in recent years. Since the launch of ChatGPT in late 2022, we’ve seen a rapid acceleration in the development of large-scale AI platforms, which have in turn, enabled a growing ecosystem of tools and applications across all industries. Supporting this surge in capability is an expanding value chain of specialist hardware and infrastructure – high-performance semiconductors, advanced packaging technologies and the data centres and interconnects needed to power them.

US stocks have led the enthusiasm…

For most investors, the definitive poster child of the AI era has been Nvidia. Once a niche graphics chip maker, it has become synonymous with the infrastructure powering modern AI. The company’s share price has soared as demand for its graphics processing units (GPUs), which power the vast majority of AI data centres, has translated into exceptional earnings growth. While its valuation has at times looked stretched, the scale and speed of its ascent have rapidly made it one of the most widely owned stocks in global equity markets.

It’s a remarkable story, but also a familiar one. When investor enthusiasm for a theme reaches fever pitch, it’s common for valuations to rise rapidly in anticipation of future growth. Indeed, often the exuberance will take share prices further than fundamentals can ultimately justify. From Japan’s own asset bubble in the 1980s to the dotcom boom at the turn of the millennium, markets have repeatedly shown that such extreme popularity can be a double-edged sword. As Ben Graham, one of the greatest investors of the 20th century, once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Popularity can lead to stellar performance while the enthusiasm builds, but in the long run, history demonstrates how it can become a liability when a bubble bursts.

…but Japan also has its beneficiaries

That’s why it’s important to stay focused on fundamentals – and one reason Japan stands out. While US stocks have dominated the AI narrative so far, Japan is home to several businesses with meaningful exposure to the AI value chain, but without the elevated valuations that can accompany the spotlight.

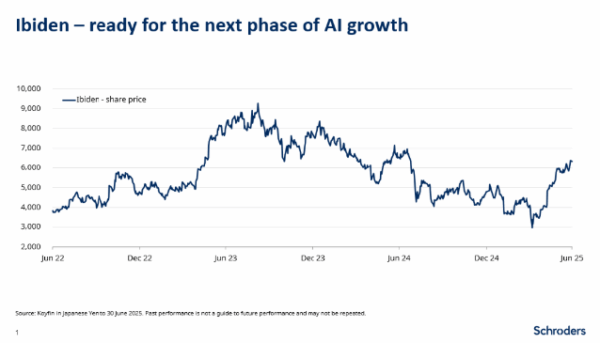

One such business held in the Schroder Japan Trust portfolio is Ibiden, a mid-cap manufacturer of high-end integrated circuit (IC) packaging substrates. These components form the critical base layer that connects a semiconductor chip to the rest of the system – managing the flow of power, data and heat to enable faster processing, energy efficiency and thermal stability in the advanced processors that AI servers and data centres rely upon. Ibiden isn’t designing the chips themselves, but it is helping to make the architecture possible – a behind-the-scenes role that is increasingly vital as the demands on computing power grow.

While Ibiden may not have been among the early beneficiaries of the AI boom, that’s largely because it was preparing for it. Over the past two years, the company has invested heavily in new production capacity, expanding facilities in Japan and the Philippines to meet future demand for advanced substrates. That investment initially weighed on earnings – with rising costs and depreciation arriving well before the revenue uplift.

But with that capacity now becoming operational, and broader AI infrastructure demand moving into its next phase of growth, Ibiden is now much better positioned to capture the opportunity. Recent margin improvement and stronger earnings guidance suggest the groundwork is beginning to pay off – and investor recognition is starting to follow.

Ibiden’s appeal goes beyond its improving market position, however. The company is also an example of the corporate governance reforms that are driving better performance from Japanese businesses more broadly. A leadership transition last year was handled smoothly, with a long-serving internal executive appointed CEO to steer the business through its next phase of growth. Ibiden is also actively selling down its legacy cross-shareholdings – improving capital efficiency and aligning with investor interests – in line with the broader corporate governance improvements reshaping the market.

The broader appeal of exposure to Japan

These developments reflect wider shifts taking place in Japan. Structural reform continues to progress, shareholder returns are improving, and corporate fundamentals are benefiting from a more favourable macroeconomic backdrop. Inflation – long absent from Japan’s economy – has returned, helping to support pricing power and break the grip of deflationary expectations. For investors, that’s a significant positive development. But for households, the effects are more nuanced. Rising food prices, in particular, have become politically sensitive – contributing to a decline in public support for the ruling Liberal Democratic Party (LDP).

That discontent was brought into sharp focus in Japan’s Upper House elections earlier this month. For the first time since 1955, the LDP no longer holds a majority in either chamber of Japan’s parliament. This marks a significant moment in Japanese politics and introduces a degree of policy uncertainty.

Nevertheless, it does not undermine the underlying investment case for Japan. As well as the governance reforms and improving macro fundamentals, Japan remains a large, liquid, but relatively inefficient equity market – particularly in the small and mid-cap space – where active management can add real value.

With selective exposure to exciting stocks such as Ibiden – and a disciplined focus on valuation and long-term fundamentals across the portfolio – we are confident that Schroder Japan is well positioned to capture the opportunity that lies ahead.

Click here to find out more about the Schroder Japan Trust plc >

Risk considerations – Schroder Japan Trust plc:

Concentration risk: The fund may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the fund, both up or down.

Counterparty risk: The fund may have contractual agreements with counterparties. If a counterparty is unable to fulfil their obligations, the sum that they owe to the fund may be lost in part or in whole.

Currency risk: If the fund’s investments are denominated in currencies different to the fund’s base currency, the fund may lose value as a result of movements in foreign exchange rates, otherwise known as currency rates. If the investor holds a share class in a different currency to the base currency of the fund, investors may be exposed to losses as a result of movements in currency rates.

Derivatives risk: Derivatives, which are financial instruments deriving their value from an underlying asset, may be used for investment purposes and/ or to manage the portfolio efficiently. A derivative may not perform as expected, may create losses greater than the cost of the derivative and may result in losses to the fund.

Liquidity risk: The fund invests in illiquid instruments, which are harder to sell. Illiquidity increases the risks that the fund will be unable to sell its holdings in a timely manner in order to meet its financial obligations at a given point in time. It may also mean that there could be delays in investing committed capital into the asset class.

Market risk: The value of investments can go up and down and an investor may not get back the amount initially invested.

Operational risk: Operational processes, including those related to the safekeeping of assets, may fail. This may result in losses to the fund.

Performance risk: Investment objectives express an intended result but there is no guarantee that such a result will be achieved. Depending on market conditions and the macro economic environment, investment objectives may become more difficult to achieve.

Smaller companies risk: Smaller companies generally carry greater liquidity risk than larger companies, meaning they are harder to buy and sell, and they may also fluctuate in value to a greater extent.

Gearing risk:The fund may borrow money to make further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase by more than the cost of borrowing, or reduce returns if they fail to do so. In falling markets, the whole of the value in that investment could be lost, which would result in losses to the fund.

Capital Erosion: As a result of fees being charged to capital, the distributable income of the fund may be higher, but there is the potential that performance or capital value may be eroded.

The price of shares in the Company is determined by market supply and demand, and this may be different to the net asset value of the Company. This means the price may be volatile, meaning the price may go up and down to a greater extent in response to changes in demand.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk.

Before investing in an Investment Trust, the latest Key Information Document (KID) at www.schroders.co.uk/investor or on request.

For help in understanding any terms used, please visit address https://www.schroders.com/en-gb/uk/individual/glossary/.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Leave a Reply

You must be logged in to post a comment.