Jun

2025

The Asset Allocators: Five risks that investors should watch

DIY Investor

23 June 2025

Our experts are broadening their safe haven exposure…by David Brenchley

This is the second in our new, quarterly asset allocation article, where every three months we ask a panel of experts from the wealth and asset management industry how their portfolios are positioned and where they are seeing buying opportunities for attractive long-term investments.

This month’s panel is: Daniel Lockyer, senior fund manager at Hawksmoor Investment Management, Peter Walls, portfolio manager at Unicorn Asset Management, Rebekah McMillan, associate portfolio manager at Neuberger Berman, and Philip Chandler, chief investment officer at Schroder Investment Solutions.

A lot has happened since we last caught up with our panellists, much of which we’ll gloss over in the interest of time – you probably know the headlines by now.

In short, US President Donald Trump’s tariff imposition led markets on a rollercoaster ride; we’ve basically come full circle and are back where we started. The 30-day tariff pause (due to end in early July) sparked a Taco (Trump Always Chickens Out) trade rally and stock markets have bounced back to trade above pre-Liberation Day levels.

Some now suspect that the ultimate tariff level will be lower than previously thought. “Yes, there’s still going to be volatility as the trade talks ensue, but the notion of flexibility from policymakers has been reinforced,” Rebekah McMillan from Neuberger Berman said. “There’s a clear desire to remove those worst outcomes in terms of both markets and the economy.

“We’re probably moving past peak trade tensions. I think the threshold for another real correction in markets is now higher because they’d have to do [what they did in April] or worse to shock everyone again. The caveat is that a lot of the positiveness seems to have been priced in.”

Dollar drama

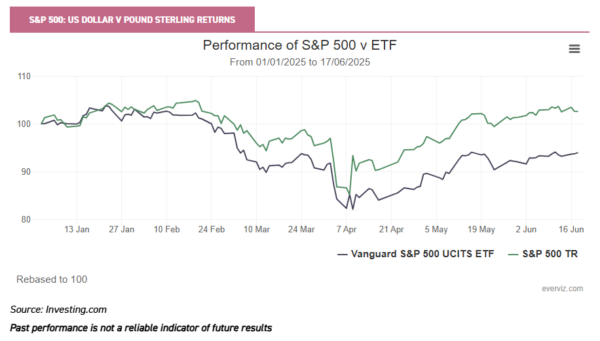

One asset that has not recovered its ground, however, has been the US dollar. The dollar index, which measures the greenback against six key overseas currencies, has fallen c. 9.8% this year. That means that while the S&P 500 is up c. 2.8% this year, the popular UK-listed Vanguard S&P 500 UCITS ETF (VUAG) has fallen c. 6.3%.

Essentially, when you convert US dollar-denominated investments back to your home currency, a weakening US dollar means those investments are worth less. This adds an additional element of risk for non-USD based investors, given the US accounts for c. 62.5% of the FTSE All-World index.

McMillan thinks that the US equity market is set to do well in an environment of high nominal growth. However, the fall in the dollar may not have finished. In her view, “what we’ve seen so far is a removal of some of the big overvaluation of the US dollar”. Anecdotally, large institutions are currently considering whether to reduce their exposure to the US dollar; the next leg down in the dollar will come when those discussions are implemented, perhaps later this year.

Philip Chandler from Schroder Investment Solutions has a similar view, believing in US exceptionalism in the long run, albeit not as strong as in the past, but having reservations in the short term, particularly in a world where most people have significant exposure to the US.

Historically, investors took the view that for those who lived, worked and planned to retire in the UK, it made sense to have a high proportion of their assets either denominated in or hedged to sterling in order to match their future liabilities.

The global financial crisis changed this, and investors started to see the US dollar as a useful hedge against market volatility. Indeed, holding dollars and other safe-haven currencies such as the Japanese yen and Swiss franc became seen as a useful portfolio construction strategy.

Chandler thinks that this may be about to change. “I think people are going to start thinking about portfolio construction again and seeing the dollar not purely as this wonderful diversifier, but also as a risk.”

The importance of diversification

Back in February, we noted that Hawksmoor had slightly increased their (still low) exposure to the US market through a fund with a value investing style, a decision Daniel Lockyer described in hindsight as “terrible”. Essentially, you’ve seen growth investing trounce value again in the US, the opposite to what has happened in most other regions.

Hawksmoor took a little bit of the cash they’d allocated there out and topped up its positions in Europe and UK equities. “When the facts change, you change your mind,” Lockyer said. “Our view is regardless of what comes out of [Trump’s] mouth, it has cast doubt over the role that the US equity and bond markets, and the dollar, play [on the world stage].

“We’d rather have more in Europe than the US. We just think Europe is going to be a beneficiary of people’s flight away from the US and away from the dollar. Even though Europe and the euro have their own problems and it’s not going to be the reserve currency of the world in the future, just diversify. You don’t need to have 60% of your assets in US equities and dollars.”

Lockyer notes that the Japanese yen continues to be undervalued, while Japan’s equity market remains attractive. “Whenever we’re investing outside of the UK, we have to think about whether we’re happy to take the currency risk as well. We like equities in Japan but we’re happy to take on the currency risk, too, because the yen is undervalued.” That currency angle pushes Hawksmoor to funds with domestic biases, “so you’re not hit by the exporters who will be hurt by a strengthening yen”.

Peter Walls from Unicorn Asset Management has a nuanced view. He does not think that the US hegemony will come to an end any time soon, but he struggles to see the US exceptionalism we’ve seen in stock markets for more than 15 years now continuing.

Walls said: “These things can continue for far longer than you ever imagine, but we still have a market that’s on a 40%-plus forward price-to-earnings premium and that represents nigh-on 70% of world indices. That just seems totally absurd to me. I don’t remember people having an index weight in Japan back in 1989 when Japan was 45% of the world index.”

For investors looking afresh at markets today, Walls is positive on Japan, where there remains “solid value” with c. 40% of Japanese companies still trading below their book value and regulators eager to improve valuations. In addition, a look through some of the UK smaller companies investment trusts, such as Rockwood Strategic (RKW) and Odyssean (OIT) reveals a long list of fundamentally undervalued businesses, while any attempt by the government to compel pension funds to invest more in their domestic markets would provide a tailwind, Walls said.

Chandler isn’t underweight US equities because they’re still delivering earnings growth and company guidance suggests a positive outlook for earnings over the next couple of quarters. However, his team has gone from having all of their equity overweight in US large caps to broadening out their equity exposure to include US financials, as well as overweights to Europe and emerging markets, given that any further trouble for the dollar will be positive for emerging economies as imports become cheaper and borrowing costs reduce.

Again, McMillan’s biggest overweights are in Europe and Japan, with neutral allocations to the US and emerging markets, but a preference within the latter for Latin America over Asia.

Safe havens no more

One theme running through our chats is that the US dollar is no longer a safe haven and bonds might not act as the only diversifier needed in portfolios.

Chandler believes we’re in a new, multi-threat world. In the past, growth was the only real risk and when growth stuttered, bonds would successfully cushion the falls seen in your equity portfolios. That’s changed and Chandler now identifies five key risks that investors must navigate moving forward: growth; inflation; market concentration; political populism which is manifesting itself in a return to economic nationalism; and fiscal sustainability.

“I think that makes portfolio construction much harder. It means you can’t just have an equity and bond portfolio and say I’m done. You need to be much more sophisticated and dynamic going forward,” he said.

Bonds remain in Chandler’s portfolios, with high yield in particular having gone from being underweight to neutral, but they’re now there more for their return-generating abilities, rather than their hedging properties.

Speaking further to the theme of less US dollar exposure, Lockyer said that Hawksmoor had reduced its exposure to US Treasury Inflation Protected Securities (TIPS). “Every line in the portfolio we ask if it fits in with the new world that we’re in and ultimately thought ‘why do we need US TIPS?’,” Lockyer said.

“In a new world where there’s fiscal unpredictability and a lack of prudence in the budgets in the US in particular, we’ve lost faith that in the event of a crisis the US treasury and dollar markets would act as perfect hedges for UK investors.”

Hawksmoor has added to both well-managed corporate bond funds, such as Man Sterling Corporate Bond and Aegon European ABS, and UK government bonds, as he feels that, whatever one’s views on what the current government is doing, “there are probably more controls than in the US where the [debt] ceiling just gets increased every time it gets to worrying levels”. “That just can’t happen in the UK so it feels like bond yields are capped.”

A golden era

One of the big key calls is that gold remains attractive, with numerous structural tailwinds for the precious metal. Indeed, if most believe that the US dollar is no longer a safe haven, then gold is the most obvious alternative.

Walls sees plenty of scope for the so-called fear trade that has propelled gold up c. 46% in US dollar terms and c. 38% in sterling terms to continue, further boosting the price of gold and other precious metals such as silver. In addition, the likes of copper have a further tailwind in that they are widely used in alternative energy production.

To get access to this, Walls owns shares in both Golden Prospect Precious Metals (GPM) and BlackRock World Mining (BRWM), which invests in gold miners. Crucially, the miners’ share prices have failed to keep up with the spot price.

Hawksmoor has exposure both to physical gold through the WisdomTree Core Physical Gold ETC (GLDW) and gold miners through Konwave Gold Equity, which both feature in the five largest holdings of the MI Hawksmoor Vanbrugh fund.

Lockyer said: “We think gold is ultimately the best safe haven out there especially in the current environment. We have become a little bit concerned that they tend to trade in line with the Nasdaq and it seems to be a risk asset. Certainly, miners are very volatile, so we’ve been regularly top slicing.”

Chandler has been overweight gold, liking its diversification properties but also pointing to the significant buying of gold by global central banks, which has accelerated since the freezing of Russian assets in international payment systems. However, this buying has eased recently and Chandler said he’s been taking profits on gold holdings given how far prices have risen.

Alternative investments

A couple of areas potentially of interest for investment trust readers are infrastructure, property and private equity.

At the time of our last update, Walls had just invested in the activist trust Achilles (AIC) and Hawksmoor had taken positions in some of the core infrastructure names. Since then, Lockyer has become more excited about the prospects for the infrastructure trusts, which provide government-backed and inflation-linked cashflows with high, covered dividend yields, as well as a determination to repay debts and good corporate governance.

In addition, Hawksmoor has started adding to some renewable energy infrastructure trusts, where the hope is that the low wind and solar levels of the past couple of years have been anomalies and if they revert, currently depressed net asset values could recover.

If that doesn’t play out, Lockyer will be happy to have been paid dividend yields of c. 12% to 13%, an annual return even equity investors would be delighted with, in the meantime, though he cautioned that one must be selective and confident that the dividend is fully covered and won’t be cut if taking this stance.

Walls remains positive on Achilles, as well as on the property sector, which has seen a good number of corporate activity in recent months. He’s been adding some cash to his generalist property play TR Property (TRY), which he says “has had a tough period but is well positioned for any recovery in demand for property-based investments under a great fund manager with a very good long-term track record”.

Another move we mentioned in February was that Neuberger had started dipping their toes back into private equity. The expectation that realisations would improve as the IPO market became more active has yet to play out, but research the firm recently conducted, which you can read about here showed that private equity as a whole should be less affected by tariffs thanks to its bias towards service businesses and technology.

“Undoubtedly uncertainty is bad, but that does present an opportunity,” McMillan said. “A lot of companies staying private for longer need capital and are relying on private equity and private credit markets. That’s not good news for existing private equity investors, but if you’re looking at adding a marginal dollar now, I would say it probably represents a good opportunity.”

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.