Aug

2025

The Japan fund we’ve bought as market hits new record

DIY Investor

19 August 2025

A trade deal with the United States has sparked a revival for Japanese shares, according to Saltydog Investor

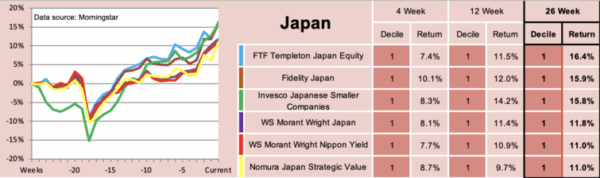

As part of our weekly analysis, we look at the performance of the Investment Association (IA) sectors over the previous four, 12, and 26 weeks. When we reviewed the numbers last week, the leading sector over four weeks was Japan, which had risen by 7.4%. The next best was China/Greater China, up 4.4%, followed by Technology & Technology Innovation, with a four-week return of 3.7%.

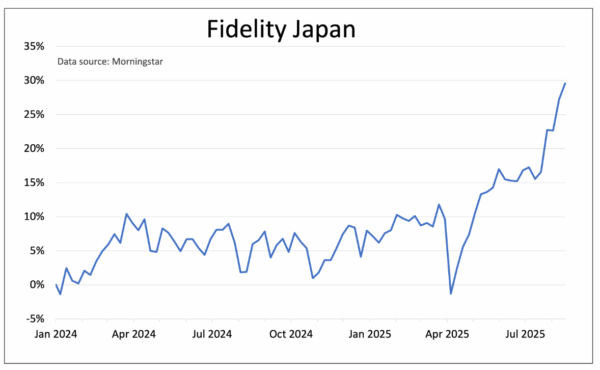

On the back of this recent strength, we added the Fidelity Japan fund to one of our demonstration portfolios. It has already gone up by 1.6%.

Last week, it was reporting the highest four-week return in its sector and sits in decile one over four, 12, and 26 weeks.

Japanese markets have been buoyed by a series of positive developments. On 22 July, a trade agreement between the US and Japan lowered the baseline reciprocal tariffs on Japanese imports from a threatened 25% to 15%. Car tariffs were also cut from 25% to 15%, giving Japanese manufacturers a clear advantage over rivals in Canada and Mexico.

In return, Japan committed to further opening its domestic market and pledged $550 billion (£406 billion) of investment into US strategic sectors, including semiconductors, pharmaceuticals, steel, shipbuilding, critical minerals, energy, and artificial intelligence (AI) technologies. The agreement also included a major aircraft order for Boeing Co BA 1.51%. The Nikkei 225 responded by climbing to a one-year high.

The momentum has continued to grow, helped by the extension of the trade negotiations truce between the US and China. Rising expectations of a US interest rate cut, along with strong results from Japanese technology and semiconductor companies, have added further support.

At the same time, the Japanese economy appears to be undergoing a structural shift. Inflation has remained above 2% for the longest stretch in more than 30 years, wages are rising, and GDP growth is improving. A weak yen continues to provide a boost to exporters. The Nikkei 225 has since gone on to set a new all-time high.

This follows a difficult three decades for Japan. Between 1995 and 2025, annual GDP growth averaged less than 1%, while the country struggled with deflation, an ageing population, and a shrinking workforce. The stock market reflected these challenges. After peaking at 38,916 in December 1989, the Nikkei tumbled, dropping below 8,000 by 2009. The recovery that followed gained traction under Shinzo Abe’s policies of monetary easing, structural reform, and export growth. Last year, the index finally surpassed its 1989 peak and broke through 39,000. It has now pushed above 43,000.

For most of the past 18 months, the Fidelity Japan fund moved sideways. It then fell sharply at the beginning of April as global stock markets reacted to the announcement of America’s two-tier tariff policy.

Since then, it has not only recovered but continued to trend upwards.

After such a sharp rise in a relatively short period, there’s always the risk that investors may feel they have missed the boat. However, Japanese equities still look inexpensive compared with the US, and if conditions remain favourable, the rally could have further to run.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.