Jul

2025

The Land of the Rising Sun – is now a good time to invest?

DIY Investor

30 July 2025

DIY Investor Spotlight Comparison – Fidelity Japan Trust & Schroders Japan Trust

Created by artificial intelligence, curated by David Wetz

Introduction

Many investors are now seeing Japan as an especially attractive place to invest and there are several reasons why it might be a good idea to consider Japanese funds like Fidelity Japan Trust and Schroder Japan Trust alongside their specific features.

Before talking about those specific trusts let’s give a summary of the ‘why’.

Japan’s economy and stock market have entered a new phase after decades of stagnation. For a long time, Japan suffered from deflation—falling prices, weak consumer spending, and slow growth. But in recent years, this is changing. Nominal wage growth in Japan reached its highest level in decades at the end of 2024, and the country is finally moving towards sustainable, mild inflation. Why is this important? Well, it’s important because healthy inflation can boost both business profits and consumer spending, creating a better backdrop for investments. It starts to lay that foundation.

There is also talk about whether the Yen is poised for a revaluation, which would most likely benefit foreign investors, as Japan’s monetary policy usually shifts more hawkishly than other countries. It would probably be a gradual appreciation, but one that would further help and encourage the investment landscape.

In addition, other corporate governance reforms and Japanese companies trading at lower prices relative to their profits than US or European peers, all help paint an interesting picture for good reasons why it may be an attractive proposition. A shift to domestic consumption – making profits less dependent on global currency swings – will also strengthen that investment outlook.

Finally, and depending on your own thoughts but here’s possibly another interesting and good reason reason. Japan has already attracted some noteworthy investor interest, and in particular, Berkshire Hathaway has signalled its long-term commitment to the Japanese equity market with $24bn invested in the region.

So, if you’re thinking about investing in Japanese stocks via London-listed investment trusts, DIY thinks two solid options stand out: Fidelity Japan Trust and Schroder Japan Trust. Both aim for long-term growth by investing in Japanese companies but have different styles and features worth knowing.

Let’s take a look

Fidelity Japan Trust focuses on growth, especially in small- and mid-sized companies that show strong potential. It’s managed by Nicholas Price, who has decades of experience at Fidelity. This trust typically doesn’t pay dividends. It’s all about capital gains and it can also invest in unlisted companies, searching for promising “hidden gems.” However, because it tilts towards smaller, growth-oriented companies, the trust can be more volatile and performance may fluctuate more sharply.

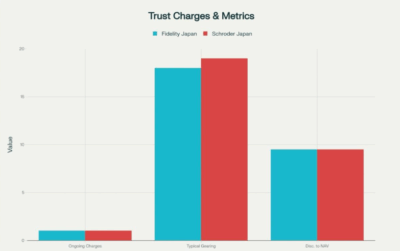

Its ongoing charges are around 1.03%, and it usually borrows (gears) around 18-20% to potentially enhance returns. Investors can usually buy the trust at an 8–11% discount to its net asset value.

Its ongoing charges are around 1.03%, and it usually borrows (gears) around 18-20% to potentially enhance returns. Investors can usually buy the trust at an 8–11% discount to its net asset value.

On the other hand, Schroder Japan Trust appears to take a steadier path, favouring larger, more established companies, often with a value focus. The manager, Masaki Taketsume, has a strong track record and prefers companies like Hitachi and Toyota. This trust appeals to those who want regular income.

It pays a healthy dividend yield of about 4.1–4.4%, typically distributed quarterly. Fees are slightly lower, generally under 1%, and gearing is used more conservatively (up to 15%).

Like Fidelity, Schroder Japan trades at a discount, usually between 9–12%. Its approach often means less volatility and smoother returns, but potentially less growth upside compared to Fidelity.

Performance-wise, Schroder Japan Trust has recently outperformed its benchmark, benefiting from disciplined stock selection and modest gearing. Fidelity’s returns have been mixed, reflecting the challenges of smaller, growth-focused companies in the current market environment.

In summary

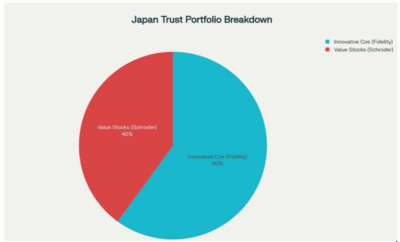

In short, if you want aggressive growth and don’t need income right now, Fidelity’s focus on smaller, innovative companies might suit you, but if you prefer steady income from dividends and a bit more stability through larger, value-oriented stocks, Schroder Japan Trust could be a better match.

Both trade at a discount, meaning you’re buying their underlying shares for less than their net worth — a potential opportunity if you believe in their strategies.

Whichever you choose, it’s important to remember that investing always carries risks, and past performance doesn’t guarantee future results. If you’re unsure, talking to a financial advisor is a smart move, but we think the Land of the Rising Sun might just be worth a closer look.

|

|

Fidelity Japan Trust Fund Manager – Nicholas Price

|

Schroder Japan Trust

Fund Manager – Masaki Taketsume

|

|

Aim |

Focuses on growth, especially in small- and mid-sized companies that show strong potential. It can also invest in unlisted companies, searching for promising “hidden gems.” |

Favours larger, more established companies, often with a value focus. This trust appeals to those who want regular income. |

|

FM |

Nicholas Price has decades of experience at Fidelity. |

Masaki Taketsume has a strong track record and prefers companies like Hitachi and Toyota. |

|

Dividend Yield |

This trust typically doesn’t pay dividends, it’s all about capital gains. |

It pays a healthy dividend yield of about 4.1–4.4%, typically distributed quarterly. |

|

Charges & Gearing |

Its ongoing charges are around 1.03%, and it usually borrows (gears) around 18-20% to potentially enhance returns. |

Fees are slightly lower, generally under 1%, and gearing is used more conservatively (up to 15%).

|

|

Discount |

Investors can usually buy the trust at an 8–11% discount to its net asset value. |

Like Fidelity, Schroder Japan trades at a discount, usually between 9–12%. |

|

Overall |

However, because it tilts towards smaller, growth-oriented companies, the trust can be more volatile and performance may fluctuate more sharply. |

Its approach often means less volatility and smoother returns, but potentially less growth upside compared to Fidelity. |

See Kepler’s latest research on Schroder Japan Trust >

See Kepler’s latest research on Fidelity Japan Trust here >

Investor perceptions of Japan are changing. Here’s why.

Investor perceptions of Japan are changing. Here’s why.

On a recent visit to the UK, Nicholas Price, portfolio manager of the Fidelity Japan Trust spoke to Ed Monk about the reasons behind the most recent resurgence in Japanese stock markets. They also discussed what to expect when investing in Japan compared to other developed markets and the changes he’s seeing on the ground which are generating stock picking opportunities.

A disciplined and differentiated approach

A disciplined and differentiated approach

Masaki Taketsume, portfolio manager, has crafted a successful and distinctive investment approach by identifying mispriced stocks. SJG should appeal to income-seeking investors with an aim to pay a dividend of 4% of net asset value annually

Meet the manager – Masaki Taketsume

Leave a Reply

You must be logged in to post a comment.