Jan

2025

The Reincarnation of Prada

DIY Investor

17 January 2025

In the movie “The Devil Wears Prada,” Miranda Priestly, the formidable editor-in-chief, declared, “Florals? For spring? Groundbreaking.” She personified the uppity, sceptical dismissive ‘know-it-all’ expert, exuding a put-down attitude towards any trend which she was not the first to spot – by Samir Mehta

Investing in turnaround stocks certainly needs that type of healthy scepticism. After painful experiences from my naïve younger days of misidentifying potential turnaround businesses, I’ve mostly eschewed that practise.

Yet one segment still catches my interest – a well-established brand, encountering tough times. One of our screens which focuses on improvements in incremental operating and free cash flows, highlighted Prada as an opportunity.

Between 2016 to 2019, Prada’s financial performance was anaemic. A greater reliance on wholesale distribution (as opposed to direct-to-consumer retail), stores at some undesirable locations and rudimentary online marketing efforts didn’t help. Yet all was not lost.

An established brand, a founder team (who own 80% of the business) with a long-term commitment to fashion and legacy and importantly, their willingness to hire professionals. Prada generated minimal operating cashflows but had low debt (other than committed leases). Stagnant sales and low profit margins stood starkly against the might of LVMH, the clear and distinct leader in luxury.

There is turmoil in the luxury industry

The pandemic, government stimulus and inflation have somewhat reshaped aspects of the industry.

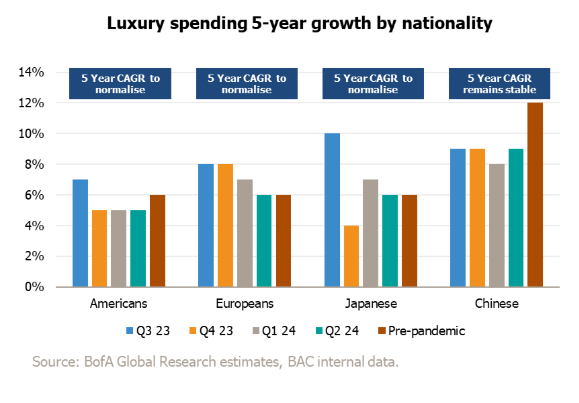

Pre-pandemic, Chinese consumers were the driving force for luxury goods. During and post-pandemic, demand was fuelled by Western consumers assisted by government stimulus and a shift in spends from services to goods. In 2023/4, inflation and rising interest rates have dented disposable incomes.

Perhaps most underestimated was the moderation of demand in China. A slower economy, poor job market, falling property values and a clampdown by the CCP on conspicuous consumption became strong headwinds.

In a way, Prada is lucky with marginal presence in the U.S. where luxury spends have come off the sharpest in 2024. Industrywide, sales growth polarisation between brands seems to have further accelerated.

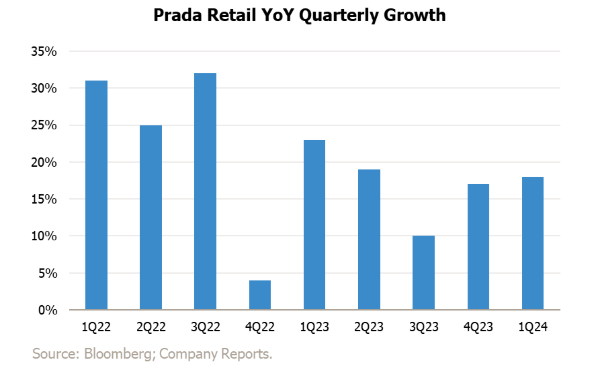

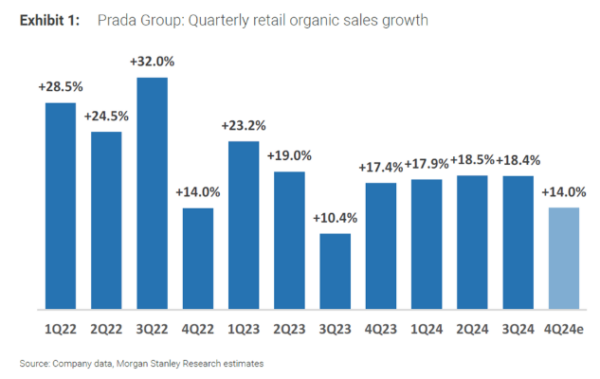

Just Prada, Hermes and Brunello Cucinelli still delivered double-digit revenue growth in 2Q24. Some brands in turnaround remained under significant pressure (Gucci and Saint Laurent within Kering, Burberry and Swatch Group), with sales down in double-digits. Margin pressures were exacerbated by FX headwinds, particularly from JPY and RMB. 1H24 EBIT for the sector declined 11% YoY.

Prada seems to buck the trend

In Prada’s case, a confluence of factors over the past 5 years seems to have made a marked difference. Decidedly shifting away from wholesale distribution meant initial disruption in sales. Yet once accomplished, brought back complete control on inventory and pricing. They revamped online marketing and influencer engagement. Millennials and Gen Z, once dismissed as fickle, became the new darlings of luxury retail. Prada courted them not with florals for spring, but with sustainability initiatives and inclusive marketing. They spoke the language of the young, not in patronizing tones, but with the authenticity of a brand reinventing itself. Product mix was another key factor. Prada and Miu Miu diversified their offerings, creating a balanced portfolio. They refocused on craftsmanship and heritage. In a world of fast fashion and disposable trends, Prada doubled down on quality. They embraced their history not as a burden, but as a differentiator.

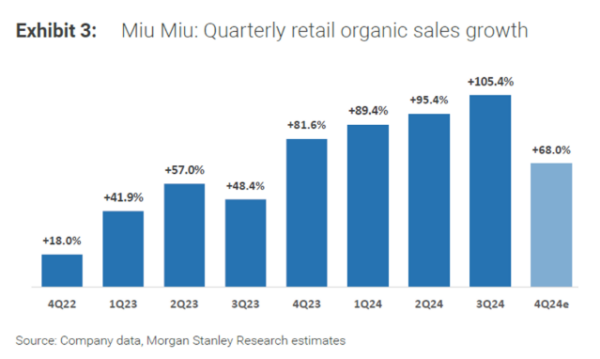

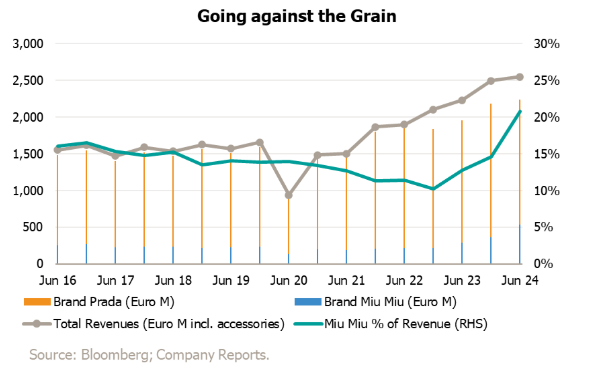

‘Miu Miu’ – Something changed

Miu Miu, historically a small brand withing the Prada group, which rarely surpassed €500m in annual revenues with volatile growth patterns, seems to have struck a chord amongst the younger generation of shoppers. In a way, you do expect brands out of nowhere gaining traction in a social media influencer dominated world, but for a long existing brand to achieve this sort of growth is staggering.

Needless to say, with a high base, revenue growth in 2025 will see a moderation. Besides, we need to monitor how sustainable is this supercharged growth, when the industry at large is struggling. If they do have the brand pull, which leads to growth of 20-25% in 2025, the margin expansion should be a positive upside too.

Ultimately, similar to any business, the right people make all the difference. Patrizio Bertelli and Miuccia Prada (78 and 75 years old respectively) made several changes to the management team. Their elder son Lorenzo, joined in September 2017 is group CMO

while a highly experienced management team (Andrew Guerra group CEO, Andrea Bonini CFO and Gianfranco d’Atttis Prada brand CEO) were appointed in 2H22 to professionalise the company even further. On the creative side, the 2020 appointment of Raf Simons (56) as co-creative director of the Prada brand alongside Miuccia Prada, seems to have boosted creativity and commerciality while ensuring a stable succession plan to Ms. Prada in the longer term. From all accounts, the experienced and talented Belgian designer who previously worked with Jil Sander, Christian Dior and Calvin Klein while running his own label. Ms. Miuccia Prada and Raf Simon’s joint collection (starting with S/S’21 and F/W21) were well received by fashion critics.

In 2024, all geographies grew double digit except US which grew 9%. Europe at 18%; APAC 16% (China low double digit) Japan 46% (mainly Chinese tourist) and Middle East 15%. The star of course is Miu Miu with a 90% growth which at current run rate could take it to Euro 1b annual sales. Miu Miu is currently almost 22% of total revenues.

To demonstrate such strength globally during a challenging period for the industry is an achievement. There is no room for complacency in any business let alone fashion. It is fitting that there are rumours of a sequel to ‘Devil Wears Prada’ though press reports have denials from many involved. With celebrities and gossip, once can never be sure. Yet if there was to be one, I wonder whether Priestly will climb down from her high horse and acknowledge the new kid on the block? Will the markets recognise Prada for its resilience and renaissance and afford it much higher multiples than it had in the past?

Samir Mehta is Senior Fund Manager, JOHCM Asia Ex Japan Fund

Leave a Reply

You must be logged in to post a comment.