Sep

2025

Three funds that pass consistency test

DIY Investor

4 September 2025

Research by Saltydog Investor uncovers three funds that have delivered gains of at least 5% in each of the last six six-month periods.

Every three months we update our 6×6 report, which looks for funds that have delivered gains of at least 5% in each of the last six six-month periods. It’s a tough challenge, and it’s not unusual if no funds make the grade.

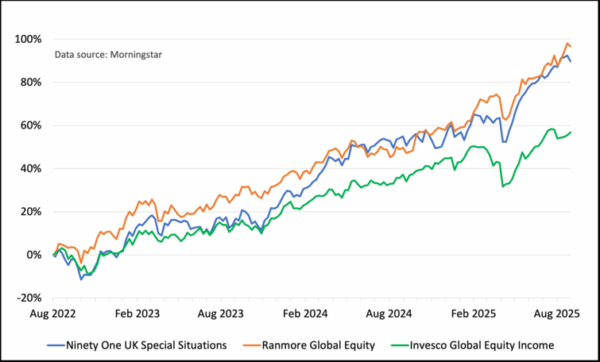

However, in our latest report three funds achieved it: Ninety One UK Special Situations, Ranmore Global Equity, and Invesco Global Equity Income.

Here’s how they performed in each of the six periods:

| Saltydog Investor 6×6 Report – August 2025 | Aug 22 | Feb 23 | Aug 23 | Feb 24 | Aug 24 | Feb 25 |

| to | to | to | to | to | to | |

| Jan 23 | Jul 23 | Jan 24 | Jul 24 | Jan 25 | Jul 25 | |

| Funds that have risen by 5% or more in 6 out of 6 periods | ||||||

| Ninety One UK Special Situations | 11.2% | 5.3% | 11.9% | 19.1% | 5.9% | 14.8% |

| Ranmore Global Equity | 21.7% | 5.7% | 6.9% | 9.2% | 10.7% | 14.0% |

| Invesco Global Equity Income | 6.9% | 7.7% | 7.3% | 8.9% | 11.8% | 5.4% |

Data source: Morningstar. Past performance is not a guide to future performance.

Consistency of this kind is rare, which is why these funds stand out. Each has delivered through a range of market conditions over the past three years, but they come from different parts of the investment universe.

Ninety One UK Special Situations is in the Investment Association’s (IA) UK All Companies sector. The fund invests in unloved companies that the manager, Alessandro Dicorrado, believes have long-term recovery potential. It has benefited as domestic stocks have attracted renewed interest. Its portfolio consists mainly of UK companies across sectors such as aerospace and defence, household goods, banking, insurance, tobacco, industrial services, and retail. It also holds non-UK assets, predominantly in Europe, but with some in North America and Asia. Its largest holding is Rolls-Royce Holdings RR. 0.97%, one of the UK’s best-performing companies in recent years.

Ranmore Global Equity is an actively managed fund from the Global sector. It looks for opportunities in companies trading below their intrinsic worth. With relatively little exposure to technology, it has stood out when value has outperformed growth. The fund’s primary aim is to deliver long-term real returns while assuming as little risk as possible. It does this by being geographically diversified, not taking large individual positions, and avoiding highly valued, popular companies that may be overvalued. It has relatively little invested in North America, 21% compared with 74% for its benchmark, the MSCI World Index. The fund has 40% invested in Asia, which is high for a global fund, and 20% in Europe. It is an offshore fund, domiciled in Ireland, but available in the UK, and has UK Reporting Fund Status.

Invesco Global Equity Income, as the name suggests, is in the Global Equity Income sector. Its objective is to achieve income and capital growth over the long term by investing at least 80% of its assets in companies worldwide. By focusing on firms that can deliver sustainable dividends, it has managed to balance stability with consistent growth, even in more volatile markets. Nearly 50% of the fund is invested in North America, around 20% in the UK, and 20% in the rest of Europe. Its largest holdings include Rolls-Royce, 3i Group Ord III 0.35%, Canadian Pacific Kansas City Ltd CP 0.45%, and Microsoft Corp MSFT 0.05%.

Although no strategy can guarantee future returns, the 6×6 report highlights funds that have been able to deliver steady gains over time. For investors seeking consistency, these three funds deserve a closer look.

Leave a Reply

You must be logged in to post a comment.