Feb

2025

What Drives Entrepreneurs to Launch—and to Leave

DIY Investor

11 February 2025

-

Over two–fifths (41%) of entrepreneurs start their own business seeking a flexible work-life balance, while over 40% of those who have exited cite health and family priorities as key motivations for exiting.

-

Entrepreneurs’ past and present agree financial reward is the least motivating factor in starting a business.

-

Experts reveal how to utilise your financial advisers to achieve your personal business goals, with 27% of exiters naming them a top source of support during a business exit

Private and commercial bank, Arbuthnot Latham’s latest report explores the driving forces behind entrepreneurship and business exits, shedding light on the personal side of exiting a business. Exploring the journeys of over 100 successful business owners, the research uncovers what inspired them to start their ventures, their reasons for choosing to exit, and the strategies they employed when the time came to step away.

Below, we will examine the main motivators behind starting a business, according to the report. Kevin Barrett, Managing Director of Private & Commercial Banking, Arbuthnot Latham also comments on complexities of business exits, highlighting the importance of early planning and the challenges entrepreneurs face both during and after the transition.

Nearly 50% of entrepreneurs started their own business for a better work–life balance

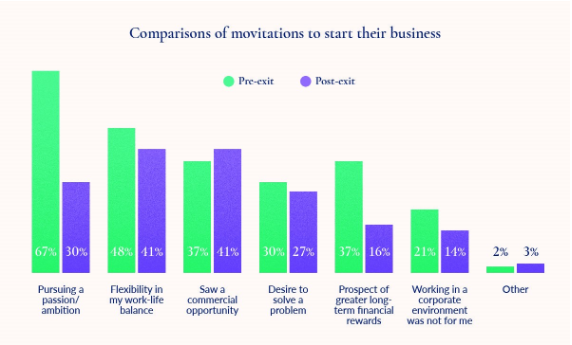

For many entrepreneurs, the motivation to start a business is driven by personal aspirations, with work-life balance being a key factor, cited by 4 in 10 exiters and nearly half of current business owners. However, the data shows that the same desire for balance can later influence decisions to exit, with 19% of entrepreneurs choosing to step away to spend more time with family, making it one of the top reasons for leaving a business.

Those still running their businesses also emphasise pursuing a personal passion or ambition, with 67% identifying this as a key driver. In contrast, of those who have exited already, just 30% were motivated by this, with flexibility in work-life balance and commercial opportunity being the biggest (41%) factors instead.

These foundational motivations underscore why exiting a business is such a nuanced and personal decision, highlighting the evolving nature of entrepreneurial priorities. The same drive that inspires entrepreneurs to start a business can later become a reason to step away.

Understanding these motivations is critical for long-term planning, ensuring that business owners are well-prepared for a successful transition when the time comes.

|

Motivation to Enter Entrepreneurship |

Post-exit |

Pre-exit |

|

Pursuing a passion / ambition |

30% |

67% |

|

Flexibility in work-life balance |

41% |

48% |

|

Saw a commercial opportunity |

41% |

37% |

|

Desire to solve a problem |

27% |

30% |

|

Prospect of greater long term financial reward |

16% |

37% |

|

Working in a corporate environment was not for me |

14% |

21% |

|

Other |

3% |

2% |

Report reveals financial reward to be one of the least important drivers in starting a business

Arbuthnot Latham’s report has revealed that one of the least common motivations for entering entrepreneurship was long term financial reward. Interestingly, the prospect of greater long–term financial reward is much more important to those still involved in their businesses versus those who have exited.

While 37% of those still running their businesses cite long-term financial reward as a key motivator, this drops to just 16% among those who have exited. Instead, exiters were more likely to be driven by commercial opportunity (41%) and the desire to solve a problem (27%). Once they had achieved their business goals, they were ready to sell. In contrast, those still involved are more likely to view their business as a passion project (67%), shaping their entrepreneurial journey through a different lens.

Arbuthnot Latham spoke with Steve Broughton, an entrepreneur who started his own business at 29, to explore what drove him to delve into the world of entrepreneurship himself:

Steve Broughton, owner of the UK’s largest independent cleaning company, said: “I realised I wasn’t driven by the corporate game. I wanted freedom and independence—things I couldn’t find in a traditional job. I wasn’t motivated by money or an exit strategy when I started. It was about living and dying by my own sword. I loved the idea that every effort I made was for me, and I was the one who would reap the rewards or face the consequences.

“One of the biggest challenges was not knowing what I didn’t know. When you don’t have experience, you learn through trial and error, which can be painful.

“Another major hurdle was scaling the business. Every time we hit a new revenue milestone – £1 million, £3 million, £5 million – there were new challenges, mostly around managing people. Hiring and motivating the right team was incredibly difficult. I underestimated how much time I needed to devote to training and developing my employees. Looking back, I wish I had spent more time on that, rather than trying to do everything myself.”

“…On a personal level, the emotional side of exiting was difficult too. Selling the business felt like giving away part of my identity. You don’t realise how much a business becomes part of who you are until you’re faced with letting it go.”

Kevin Barrett, Managing Director of Private & Commercial Banking, Arbuthnot Latham comments on the results and the emotional and strategic complexities of business exits;

“Exiting a business is one of the most significant decisions an entrepreneur can make. It’s not just a financial transaction but a deeply personal and emotional transition. This report highlights the diverse triggers for an exit, from achieving goals and seeking new challenges to personal wellbeing and external factors like market dynamics and tax policies.

For many, the exit journey begins with understanding their motivations. Entrepreneurs who aligned their exit plans with personal and professional goals were more likely to experience satisfaction. However, those who lacked clarity or preparation often faced emotional and logistical challenges.

The due diligence process emerged as a pivotal, often grueling stage, testing resilience and readiness. Entrepreneurs who built a trusted team of advisers and started planning early navigated this phase more effectively. Yet, even with preparation, the emotional toll of letting go – a loss of identity and purpose – remained a common theme.

Life after the exit brings its own challenges and opportunities. While some entrepreneurs embraced family time, hobbies, or philanthropy, others sought lighter involvement through advisory roles or investments. For most, the post-exit phase was an opportunity to redefine purpose and success on their own terms.

And in the words of a respondent which reflects entrepreneurs’ spirit: “I’ll never be too far from building something new – it’s in my DNA. But whatever comes next will be driven by passion, not necessity.”

For the full report, please visit Arbuthnot Latham – Beyond the Balance Sheet

Sources and Methodology

Arbuthnot Latham conducted in-depth interviews with 100 UK business owners, all holding 100% ownership of businesses with a minimum turnover of £1m (29% exceeding £5m), in collaboration with leading consultancy The Wisdom Council, to explore the human side of business exits – how they balance wellbeing, financial goals, and the complexities of letting go. Shining a spotlight on the people-side of the process, thoughtful financial planning helps navigate the complexities with clarity and confidence.

Leave a Reply

You must be logged in to post a comment.